Umzugskosten: Claiming relocation expenses from tax

Moving to a new city for your dream job? Or you're expanding your family and need more room? Be it for professional, private, or health reasons, you can always claim relocation costs (Umzugskosten) in your tax return. Let’s look at the correct ways to go about it.

Quick navigation

01.

Video: Claiming Relocation Costs Using Taxfix

It’s not hard to deduct relocation costs (Umzugskosten) once you know the reason for relocation and what exactly can be claimed. For instance, relocation in your tax return is claimed differently when you’re moving for your work and when you’re moving for education. Taxfix clearly identifies and classifies tax-deductibles items in your move. In the video, we show you how to correctly claim relocation costs one step at a time.

Enter your moving expenses correctly with Taxfix. It’s easy, free, and without contractual obligation. Start your tax return

Prepare your own tax return

€39.99

For anyone who wants to file an easy and secure tax return themselves. Free refund calculation, pay only upon submission.

Receive an advance calculation of your refund and pay only when you turn it in

Guided and intuitive process with simple questions

Automatic data retrieval: simply retrieve your income data from the tax office and have it pre-filled

The general deadline applies (September 02)

€59.99 for married couples or registered partnerships looking to file a tax return together

Get your tax assessment for free and only pay when you submit your return

Our Expert Service does it for you

From €69.99

For those who are unsure or can't find the time – hand your taxes to an expert.

Provide a few necessary documents in minutes

An independent tax advisor will prepare and submit your tax return for you

Personalised document upload: Only submit documents that are completely necessary

Detailed check of your information

Benefit from an extended tax deadline (April 30, 2026)

Only pay when you receive the result of your tax assessment

02.

Where do Umzugskosten belong in the tax return?

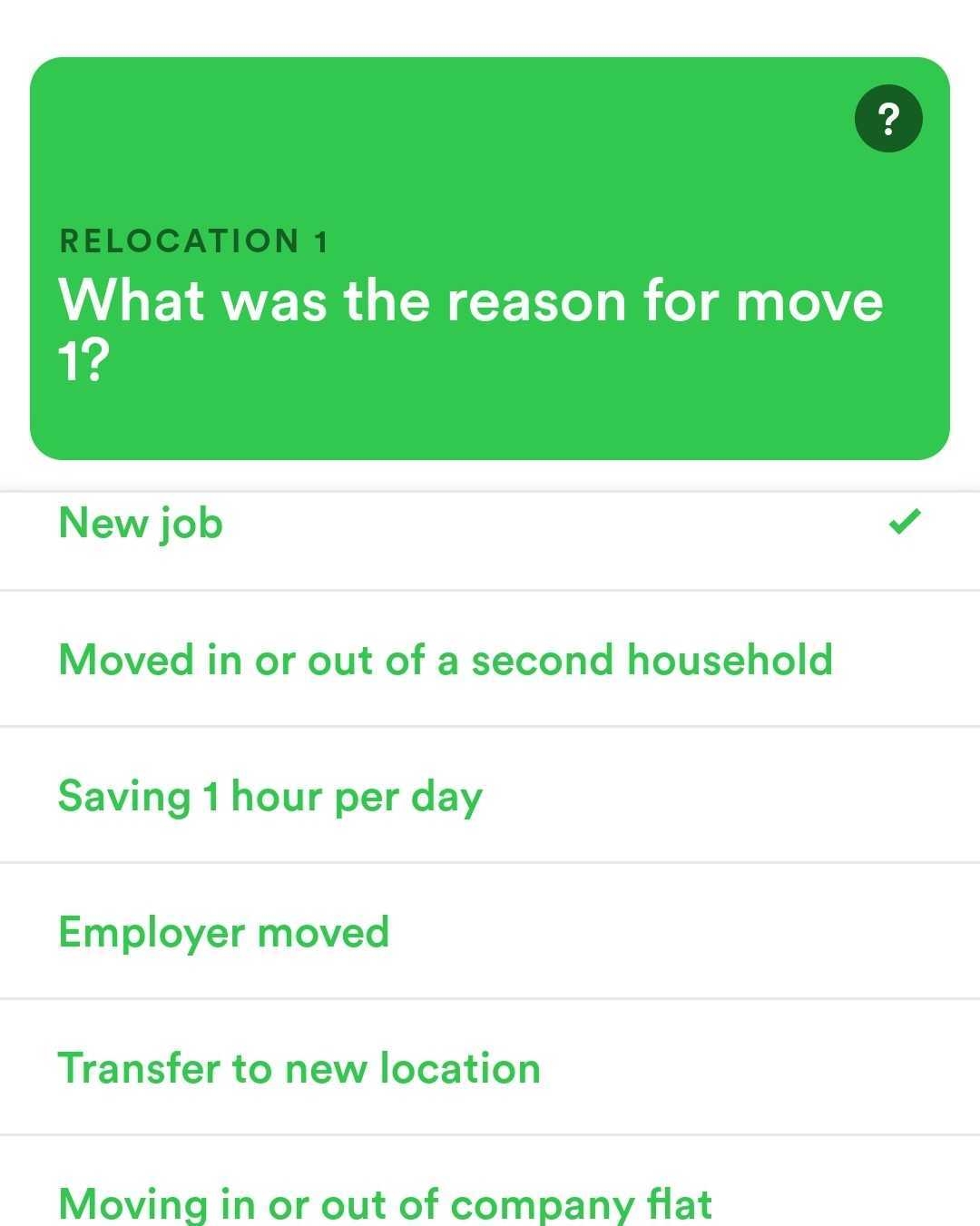

How you claim your relocation cost in your tax return depends on why you’re relocating. Relocation is covered under the following categories:

- Income-related expenses (Werbungskosten)

- extraordinary burdens (außergewöhnliche Belastungen) (content in German)

- special expenses (Sonderausgaben)

- household-related services (haushaltsnahe Dienstleistungen)

- business expenses (Betriebsausgaben)

03.

Moving for work? It’s an income-related expense

When you’re relocating because of your job, it’s classified under income-related expenses (Werbungskosten). Your relocation must justify any of the following:

- Your daily commute is at least an hour shorter (round trip) thanks to your new home

- You are starting your very first job

- You are moving due to a transfer or relocation by your employer

- Your move is related to a work-related double household (doppelten Haushaltsführung)

- You’re either moving in or out of a company apartment as a result of your work

In order to prove to the tax office that your move is work-related, you require the new employment contract or a work certificate from the company.

Normally, if your employer pays all or part of your relocation costs, you’re not allowed to deduct them from your taxes. You can claim in your taxes items or services that you paid for yourself.

General expenses:

- Necessary travel expenses to prepare for the move

- Packing and transportation of belongings

- Double rent payments for up to six months

- Costs for broker and inspection

- Repairs resulting from transportation damage

- Acquisition costs for stove (up to 230 euro) and ovens (up to 164 euro) for moves before 01.06.2020

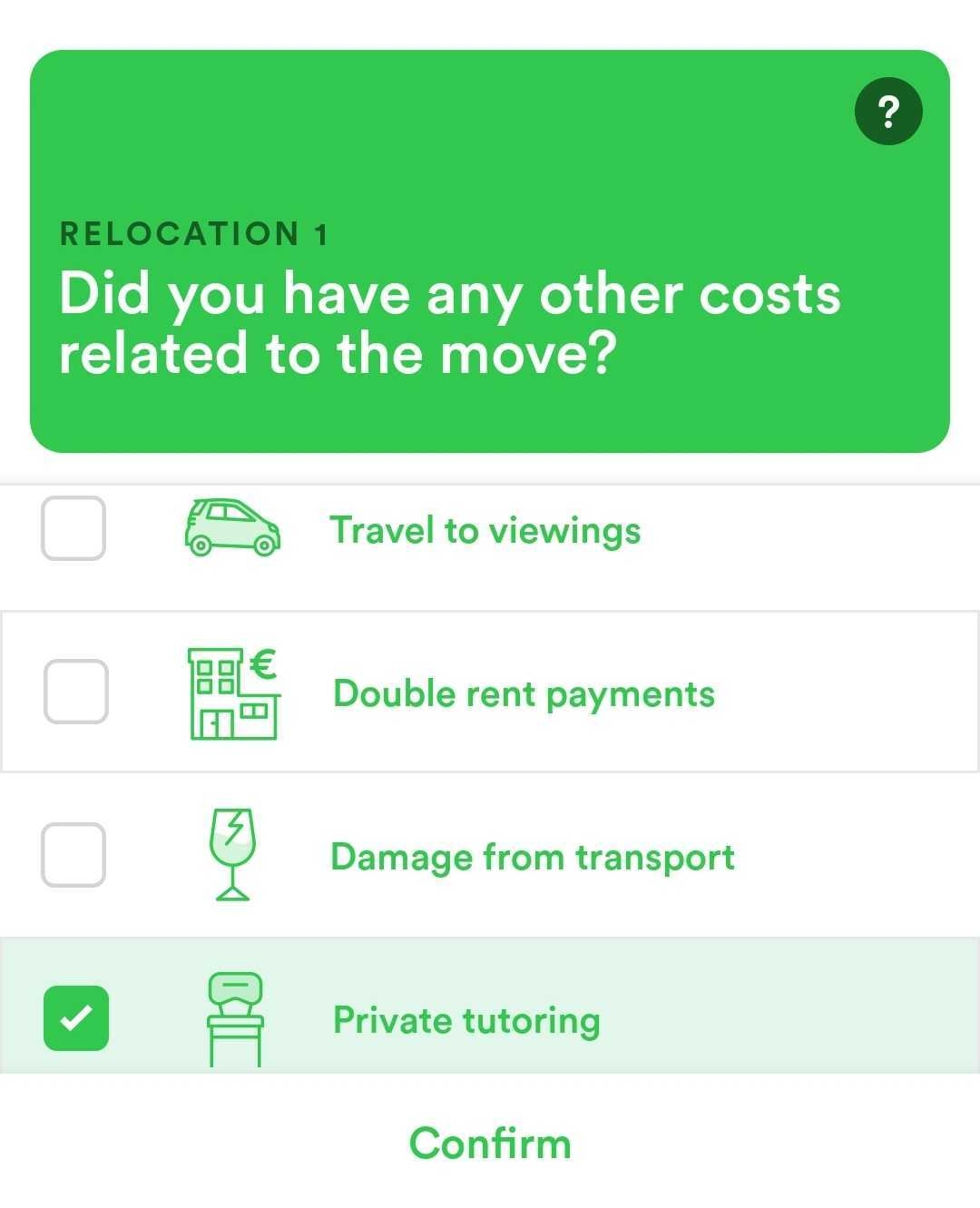

- Tutoring costs for your children if you move to another federal state

Approximate date of relocation | Fully deductible up to 50% of the maximum cost (EUR) | 75% of the second half of the maximum amount deductible (EUR) | Highest deductible limit for tuition costs (EUR) |

|---|---|---|---|

From 01 February, 2017 | 963 | 963 | 1,926 |

From 01 March, 2018 | 992 | 992 | 1,984 |

From 01 April, 2019 | 1,022.50 | 1,022.5 | 2,045 |

From 01 March, 2020 | 1,033 | 1,033 | 2,066 |

From 01 June, 2020 | – | – | 1,146 |

From 01 April, 2021 | – | – | 1,160 |

From 01 April, 2022 | – | – | 1,181 |

You can deduct tutoring expenses in the Taxfix app in the ‘Relocation 1’ category when asked, ‘Did you have any other costs related to the move?’ Select ‘Private Tutoring’.

Other relocation-related costs include:

- Advertisements related to apartment-hunts

- Re-registration fees

- Provisions for your relocation personnel

- Renovation or cosmetic repairs in the old apartment

- Fitting of lamps

- Installation of kitchen and other appliances

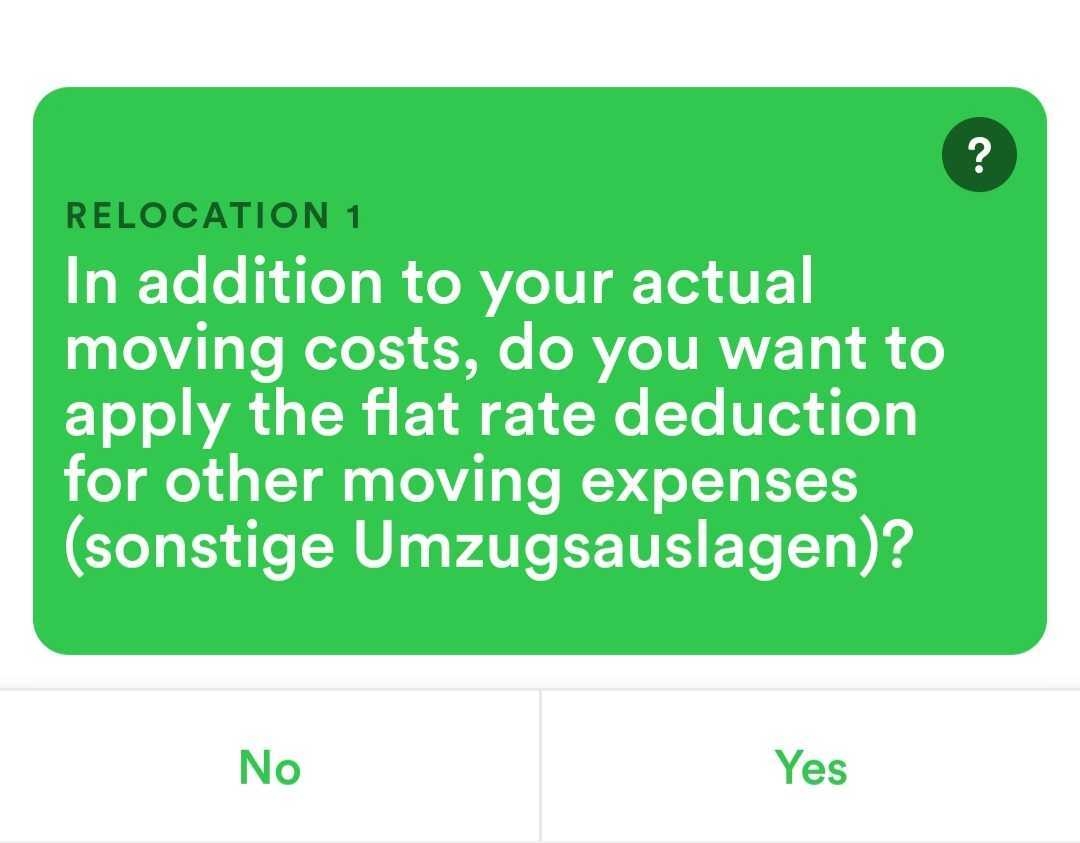

General expenses are fully deductible, but you will need all the receipts and vouchers! If you decide to use the fixed amount for relocation (Umzugspauschale), you won’t need to list the individual costs or provide receipts. The amount of the flat rate depends on the date of relocation and the number of people in the household.

Approximate date of relocation | Fully deductible up to 50% of the maximum cost (EUR) | 75% of the second half of the maximum amount deductible (EUR) | Highest deductible limit for tuition costs (EUR) |

|---|---|---|---|

From 01 February, 2017 | 963 | 963 | 1,926 |

From 01 March, 2018 | 992 | 992 | 1,984 |

From 01 April, 2019 | 1,022.50 | 1,022.5 | 2,045 |

From 01 March, 2020 | 1,033 | 1,033 | 2,066 |

From 01 June, 2020 | – | – | 1,146 |

From 01 April, 2021 | – | – | 1,160 |

From 01 April, 2022 | – | – | 1,181 |

The flat-rate relocation allowance is increased by 50% if you relocate a second time within 5 years for work-related reasons and you had your own household before and after the relocations (i.e. not when you move out of your parents’ house, for example).

In the Taxfix app, you will be asked separately in the ‘Home’ category whether you would like to claim the flat rate. Based on your information, the corresponding amount of the flat rate will be determined and automatically taken into account in the app.

What costs cannot be deducted as relocation costs?

- Purchase of new furniture

- Furniture storage costs

- Renovation costs for the new apartment

- Costs related to home ownership: e.g. losses and realtor costs resulting from the sale of a home.

- Broker costs resulting from the purchase of an apartment or house

Not sure if the fixed relocation allowance is a better choice than listing your individual costs? We can help.

Get your free no-obligation tax calculationScan your income tax certificate, and you're done!

Get it early! Submit now so the tax office takes care of your tax return early. Simply upload your income tax certificate and answer the simple questions.

Start now for free04.

Relocating for your first training? That’s a special expense

Moving counts as a special expense (Sonderausgabe) if you’re enrolled as a student or a trainee in your first professional training. Although you can claim the flat-rate relocation allowance, you can’t use the costs to carry forward losses (Verlustvortrag). If you move out of your parents’ home, the fixed relocation amount reduces by 20% (single persons) or 30% (single parents and married persons for moves up to May 31, 2020).

Your relocation expenses in this case must be calculated independently and reported in the Taxfix app in the ‘Education’ category under ‘Other expenses.’

If you relocate to pursue further professional training (e.g. master’s degree), the moving expenses are treated similarly to a job-related move i.e. as income-related expenses. This allows you to consider these expenses when carrying forward losses.

In order for the move to be recorded in the correct place in the Taxfix app, you must answer ‘Yes’ to the question: ‘Did you move because of your job?’ in the ‘Home’ category.

05.

Personal reasons for relocating? Counts as household-related service

When you are moving for personal reasons, you can claim certain costs from tax, such as payments made to the moving company, household-related services associated with the move etc. Household-related services can constitute up to 20% of the relocation costs to a maximum of 4,000 euros. You may need to prove these costs through invoices, bank transfer statements or direct debit receipts.

You cannot claim the fixed relocation amount for moving expenses for a private move.

Taxfix advantages for all

With Germany's most popular mobile tax app, you can do your tax return in no time.

Guided and intuitive process

Answer our easy-to-understand questions, or sit back and have your taxes done by an independent tax advisor.

Reliable check of your data

We check your data for plausibility through sophisticated plausibility checks.

Estimated tax refund, free of charge

If you choose to file your own taxes with Taxfix, we’ll calculate how much you can expect back from the tax office.

Efficient and secure tax returns

Only answer what's related to your case. Or have your taxes prepared and submitted by an independent tax advisor.

06.

Costs of relocating against your will fall under extraordinary expenses

Some moves are unplanned. Sometimes an illness forces a change of living situation. The person concerned has to move to live near a clinic for long-term treatment or because climbing the stairs to the fifth floor is no longer possible. With a medical certificate, you can then claim the costs as an extraordinary burden.

Your relocation costs fall into the same category if you have to leave your home due to a natural disaster, e.g. floods. You are then allowed to deduct what exceeds your personal reasonable burden limit. It is important that the move is absolutely necessary.

You cannot claim the fixed amount for relocation (Umzugspauschale) when your move is prompted by personal reasons.

The Taxfix app records these costs in the ‘Health’ category under ’Other costs’.

07.

Freelancer or self-employed? Your relocation counts as a business expense

For self-employed persons and freelancers, moving for your business is recognised by taxes. However, in order to be able to declare the expenses as business expenses, it is necessary to prove the necessity of relocation. Some plausible reasons may be the expansion of the company which calls for a larger office or a better connection to business partners and customers.

About Taxfix

With Taxfix, you can complete your tax returns from 2019-2022, in no time at all. No tax knowledge is necessary – simply choose to complete your Taxfix tax return yourself, or have an independent tax advisor do it for you. What are you waiting for?

Start now