Missed your tax deadline? Submit now

Watch out for the tax return deadline, but don't panic about filing! With Taxfix you can do your tax on time in under 30 minutes!

Table of contents - Tax return submission deadline

01.

Tax return deadline 2022: October 02, 2023 for mandatory filers

How long do I have to submit my financial statement to the tax office?

That depends on whether your tax return is obligatory or voluntary, and whether or not you use a tax advisor.

Here you can find all the dates and deadlines at a glance.

If you are obliged to file a tax return, the tax deadline is the following year.

The following submission date applies to those obliged to submit their income tax return:

- Tax return deadline tax return 2021: October 31, 2022 -> Start tax return now

- Tax return deadline tax return 2022: October 02, 2023 -> Start tax return now

- Tax return deadline tax return 2023: 02 September 2024 (possible from the beginning of 2024 with Taxfix)

Attention:

If the last day of the month falls on a Saturday, Sunday, or public holiday, the following working day becomes the deadline for submission.

02.

3 reasons why you should file right now:

1. You will receive your refund faster because the tax offices process returns in order of collection dates.

2. If you are obliged to file, you can avoid stress and a possible late fee by filing your tax return as soon as possible.

3. You’re more aware of your income and expenses than anyone else is, meaning you’ll file the most detailed and accurate tax declaration, leading to a higher refund.

Prepare your own tax return

€39.99

For anyone who wants to file an easy and secure tax return themselves. Free refund calculation, pay only upon submission.

Receive an advance calculation of your refund and pay only when you turn it in

Guided and intuitive process with simple questions

Automatic data retrieval: simply retrieve your income data from the tax office and have it pre-filled

The general deadline applies (September 02)

€59.99 for married couples or registered partnerships looking to file a tax return together

Get your tax assessment for free and only pay when you submit your return

Our Expert Service does it for you

From €89.99

For those who are unsure or can't find the time – hand your taxes to an expert.

Provide a few necessary documents in minutes

An independent tax advisor will prepare your tax return for you

Personalised document upload: Only submit documents that are completely necessary

Detailed check of your information

Benefit from an extended tax deadline (June 2nd, 2025)

Hand over, pay, relax.

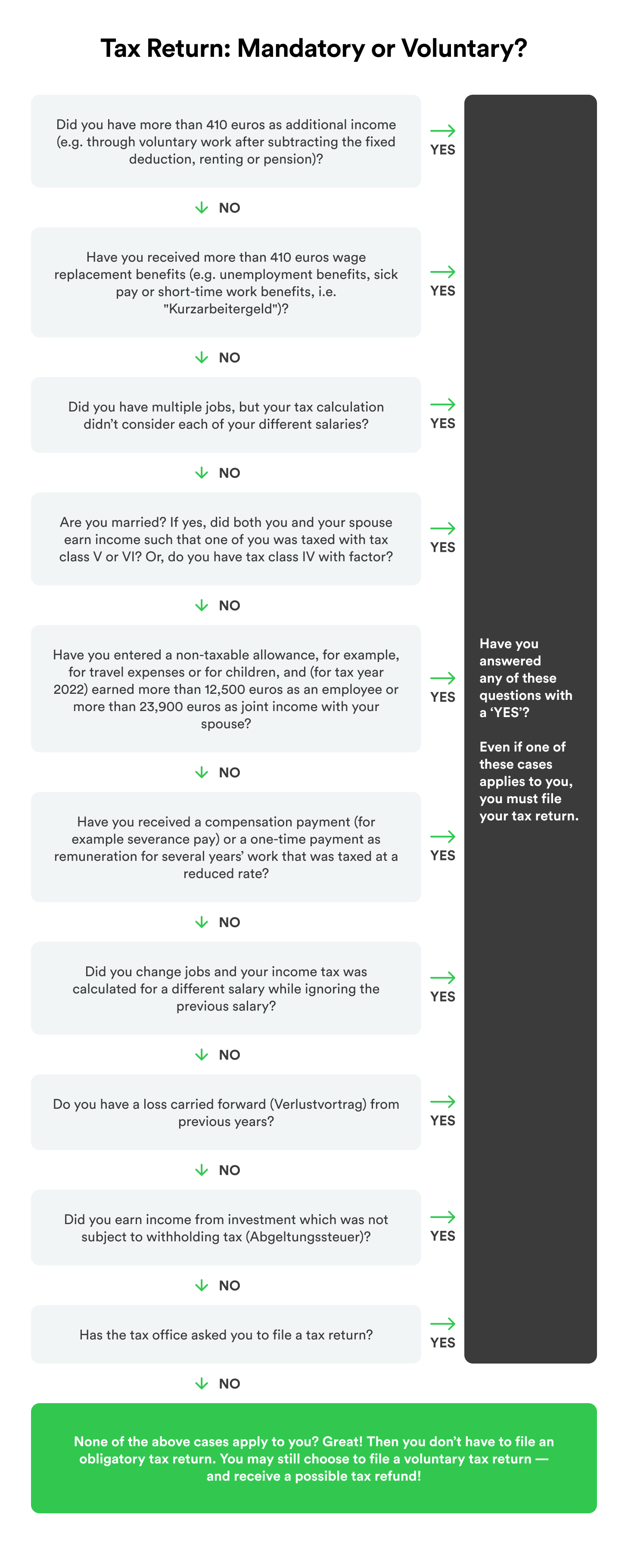

If one of the points on the checklist below applies to you, then you are obligated to file a tax return:

You can find out more about the individual points in the article "Tax liability: Who has to file a tax return?”

04.

Later submission deadline when using a tax advisor

If your tax return is prepared by a tax consultancy or income tax help association, you have more time. Due to the Corona pandemic, there are different filing deadlines for the following years.

Here is an overview of all tax advice submission deadlines:

(applies only to tax cases handled by advisors)

- Tax return deadline for 2022 tax year: July 31, 2024

- Tax return deadline for 2023 tax year: July 02, 2025

Scan your payslip, and you're done!

It's so simple and completely digital: photograph or upload your documents. Taxfix then automatically transfers all important information. Accurately and stress-free!

Start now for free05.

Voluntary tax filers: Deadlines of up to 4 years

The below deadlines only apply to persons who are obliged to file a tax return. All other employees can file voluntarily and retroactively, as far back four years.

Tax return deadline for 2020: December 31, 2024-> Find out how much you'll get back with the Taxfix app!

Tax return deadline for 2021: December 31, 2025-> Find out how much you'll get back with the Taxfix app!

Tax return deadline for 2022: December 31, 2026-> Find out how much you'll get back with the Taxfix app!

Tax return deadline for 2023: December 31, 2027-> Find out how much you'll get back with the Taxfix app!

Tax return deadline for 2024: December 31, 2028-> Find out how much you'll get back from January 01, 2025!

Taxfix tax tip:

Usually, it’s worthwhile to file a voluntary tax return, especially if your income-related expenses (Werbungskosten) exceed 1,200 euros. This 1,200-euro mark is easily exceeded with a daily one-way commute of 19 km. And apart from the commute, you may still have other income-related expenses.

Find out whether a tax return is worthwhile for you.

Answer a few questions to see what kind of refund you could expect.. Our tax calculator will determine how high your estimated tax refund will be, and whether or not it would be worth your while to submit a tax return.

07.

All tax filing deadlines at a glance

Tax year | Deadline for the mandatory tax return (filing yourself) | Deadline for the mandatory tax return with a tax advisor | Deadline for a voluntary tax return |

|---|---|---|---|

2020 | not possible anymore | not possible anymore | December 31,2024 |

2021 | not possible anymore | not possible anymore | December 31,2025 |

2022 | October 02, 2023 | June 02, 2025 | December 31,2026 |

2023 | September 02, 2024 | April 30, 2026 | December 31,2027 |

Taxfix advantages for all

With Germany's most popular mobile tax app, you can do your tax return in no time.

Guided and intuitive process

Answer our easy-to-understand questions, or sit back and have your taxes done by an independent tax advisor.

Reliable check of your data

We check your data for plausibility through sophisticated plausibility checks.

Estimated tax refund, free of charge

If you choose to file your own taxes with Taxfix, we’ll calculate how much you can expect back from the tax office.

Efficient and secure tax returns

Only answer what's related to your case. Or have your taxes prepared and submitted by an independent tax advisor.

We have already recovered over 3 billion euros for our customers! Taxfix's mission is to enable financial participation for everyone.

Tax experts work at Taxfix.

Employees counts Taxfix currently.

08.

Missed your deadline? Don't panic!

As a rule, the tax office will turn a blind eye if your tax return arrives a few days late. However, you shouldn’t allow yourself too much extra time, because you could be charged late fees.

If, for example, you know in advance that you will not meet the 2022 tax return deadline, you should apply to the tax office for an extension. Even if the last possible deadline has passed, this can save you from additional fees.

How to apply for an extension of the deadline:

You can apply for a deadline extension quite easily with an informal letter. State the reasons for the delay (for example, missing documents or illness) as well as a new favourable date of your choice (no later than 30 September) for the submission. Send the letter by post or fax to your local tax office. Make sure you quote your tax identification number. The extension is usually granted if you do not hear any opposition from the tax office to your request.

09.

What happens if I do not file a tax return?

If the tax office has not received your income tax return, or an application for an extension of the deadline, they will often send you a request for submission. The deadline the tax office stipulates in this letter must be met to avoid a late filing surcharge.

How much is the late-tax penalty (Verspätungszuschlag)?

For each month delay (or part of a month), the tax office will charge 0.25 % of your assessed tax, but not less than 25 euros.

Even If you do not receive an instruction to file, contact your tax office as soon as possible – 14 months after the end of a tax year, the tax office's discretionary powers end, and late fees will inevitably be incurred.

Example:

2019 tax return submitted on: 15.05.2021

Submission deadline: 31.07.2020.

14-month deadline: 30.09.2021

Late filing fee is charged for August 2020 to May 2021.

Please note:

If you do not submit your documents as a taxpayer, the tax office can demand your tax return within seven years. If you are missing documents like receipts when the tax office requests them, the tax office will estimate your tax - perhaps to your disadvantage.

Our experts

You're in good hands

Our team of tax experts has years of experience helping people like you with your taxes.