Mini-jobs and Side-Jobs: Are They taxable in Germany?

As you can tell from the German term 'mini-job', it's a type of employment that entails a small wage. Nevertheless, it can have implications for your tax situation and your German tax return. Here's how mini-jobs affect your tax returns.

Quick navigation

01.

What is a mini-job in Germany?

In Germany, the tax system clearly outlines 520-euro-minijobs and short-term mini-jobs. Thus, a mini-job is determined by the wage you receive or by the hours you put into the work.

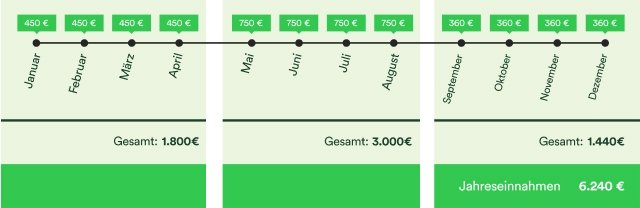

The 520-euro-minijob requires that the affected person must not earn more than EUR 520 on a regular basis. Throughout the whole year, they may earn a maximum income of 12 x 520 EUR through the mini-job. As soon as this sum is exceeded, it is not a mini-job any more. That said, in single months you are still allowed to earn more than EUR 520, if you balance the higher wage by earning less in the other months.

This is how your annual income from a mini-job could look (in German):

By the way:

One-time payments like the christmas allowance (Weihnachtsgeld) or holiday pay (Urlaubsgeld) are excluded from the annual 12 x 520 EUR.

Prepare your own tax return

€39.99

For anyone who wants to file an easy and secure tax return themselves. Free refund calculation, pay only upon submission.

Receive an advance calculation of your refund and pay only when you turn it in

Guided and intuitive process with simple questions

Automatic data retrieval: simply retrieve your income data from the tax office and have it pre-filled

The general deadline applies (September 02)

€59.99 for married couples or registered partnerships looking to file a tax return together

Get your tax assessment for free and only pay when you submit your return

Our Expert Service does it for you

From €89.99

For those who are unsure or can't find the time – hand your taxes to an expert.

Provide a few necessary documents in minutes

An independent tax advisor will prepare your tax return for you

Personalised document upload: Only submit documents that are completely necessary

Detailed check of your information

Benefit from an extended tax deadline (June 2nd, 2025)

Hand over, pay, relax.

02.

The short-term employment (kurzfristige Beschäftigung)

A short-term employment, opposed to a 520-Euro-Job, is an activity, which is set for a certain amount of time. This employment is defined by a maximum amount of 3 months if the underlying schedule is a regular 5-day work week. If you work less than 5 days a week, the regulation of maximum 70 working days a year is applicable.

With a short-term job, it doesn’t matter how much money you earn. The job is not meant to be your profession. This means that this job should be of minor significance for the employee’s financial situation. As a result, this job agreement is mostly interesting for pupils and students .

Looking for an easy way to file your taxes? Let Taxfix guide you! We cover the mini-job in our easy-to-understand inquiry-response process and help you file taxes correctly. Try it for free now

Scan your payslip, and you're done!

It's so simple and completely digital: photograph or upload your documents. Taxfix then automatically transfers all important information. Accurately and stress-free!

Start now for free03.

Is a mini-job taxable?

Whether it’s a 520-Euro-Job or short-term employment, both are taxable. Your wages can either be flat-taxed (with a fixed amount) or taxed individually following the data on your electronic annual payslip.

Your employer defines the taxation procedure. If the employing company settles for flat-taxation, the EUR 520 is tax-free for you. In this case, the employer pays the tax, which is 2% of the gross pay. This includes the church tax (Kirchenteuer) and the solidarity tax (Solidaritätszuschlag).

If your employer decides for this kind of taxation, you don’t have to state these incomes in your tax return.

Income from a short-term employment (kurzfristige Beschäftigung) is taxable. You pay taxes on the full income. The taxation works by either a flat-tax (fixed taxation) or individually.

An individual taxation follows your usual income-tax deduction criteria. The fixed deduction for short-term employments is 25 %, and possible only when:

- The employment is occasional only (not recurring)

- The maximum working period lasts for 18 consecutive days

- The wage per day does not exceed EUR 120 (from 2024: EUR 150) (average hourly compensation of max. EUR 15, from 2024: EUR 19)

Looking for an easy way to file your taxes? Let Taxfix guide you! We cover the mini-job in our easy-to-understand inquiry-response process and help you file taxes correctly. Try it for free now

Taxes made easy

Because no one speaks like a tax form, we have simplified complicated tax terms for you. Answer easy questions and get an average refund of €1,063 – no tax knowledge needed.

Start now for free