Taxes 2022: What changes in your return

New year, new tax regulations. Keep track of the updated tax regulations by reading through our article on 2022 tax changes — and keep saving!

01.

The tax changes for 2022

The tax administration always publishes changes in tax law shortly before the new year. For the beginning of 2022, these are changes that were largely planned for the long term. Usually, tax changes favour employees, especially because of the COVID-19 pandemic. However, some tax changes also revert to the pre-pandemic tax scenario. You can find an overview of all changes here.

Please note that in most cases the changes will only be relevant for the 2022 tax year, i.e. for the tax return that can be filed from the beginning of 2023. If you do your taxes with Taxfix , the following applies: The current figures are always stored for the respective tax year, so you don’t have to inform yourself or worry about possible changes!

You can find the adjustments that primarily affect the tax year 2021 (and are therefore relevant for the tax return in 2022) in our Contribution to the 2021 tax changes.

02.

Increased basic allowance (Grundfreibetrag) 2022

The basic tax-free allowance is the portion of your income on which you don’t pay taxes. At the beginning of 2022, it will increase by a few hundred euros to 9,984 euros for singles and 19,968 euros for jointly assessed couples.

03.

Changed limits: new tax rates for 2022

At the beginning of 2022, the benchmark tariff values (Tarifeckwerte) will shift by 1.17% to the right. This means that the respective tax tariff or tax rate only applies from a slightly higher amount. We have already shown how this affects the basic allowance.

The top tax rate of 42% only applies from EUR 58,597 (individual assessment) or 117,194 euros (joint assessment for married couples).

From a taxable income of 277,826 euros (single person) or 555,652 euros (jointly assessed) the wealth tax rate of 45% applies.

04.

Corona bonus tax-free until the end of March 2022

To compensate for the burdens caused by the corona pandemic, the tax authorities have granted employees a tax-free corona bonus of up to 1,500 euros. This can be paid once per employment (not per year!) and is then tax-free. It was originally valid until the end of 2021, but has now been extended until the end of March 2022.

If the corona bonus has already been paid by the current employer, an additional bonus is no longer tax-free. When changing employers, however, employees can very well benefit from several corona bonuses. The bonus payment due to the COVID-19 pandemic is, therefore, dependent on the employment relationship, not personal.

Prepare your own tax return

From €39.99

Free until your refund calculation – then from €39.99 for submission.

Receive an advance calculation of your refund and pay only when you turn it in

Guided and intuitive process with simple questions

Automatic data retrieval: simply retrieve your income data from the tax office and have it pre-filled

The general deadline applies (July 31st)

€59.99 for married couples or registered partnerships looking to file a tax return together

Save money and secure exclusive benefits with Taxfix+

Get your tax assessment for free and only pay when you submit your return

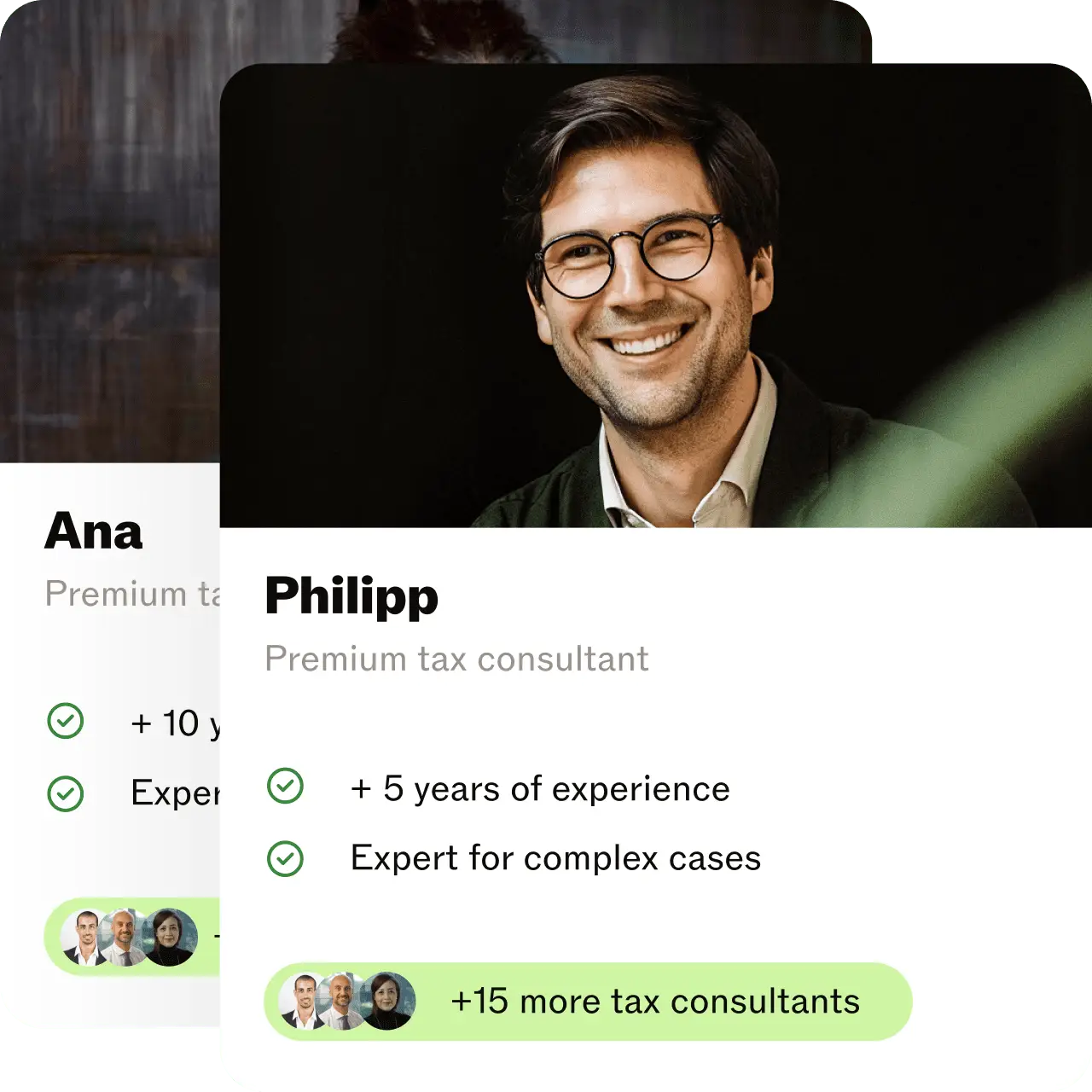

Our Expert Service does it for you

From €99.99

20% of your refund (minimum fee: €99.99).

Provide a few necessary documents in minutes

An independent tax advisor will prepare your tax return for you

Personalised document upload: Only submit documents that are completely necessary

Detailed check of your information

Benefit from an extended tax deadline (April 30th, 2026)

Hand over, pay, relax.

05.

More money for courtesy: Higher non-cash exemption limit (Sachbezugsfreigrenze)

The non-cash benefit exemption limit (Sachbezugsfreigrenze) determines when a donation must be taxed. Such courtesies to employees from the employer may be higher from the 2022 tax year. Tax-free donations of 50 euros per month are now possible, for example in the form of fuel vouchers or other vouchers for employees.

This means a tax-free annual sum of 600 euros, or a one-off donation of this amount within a year, is not possible. Never think about tax changes again: The Taxfix app automatically accounts for changes in tax law and helps you file taxes accordingly. Start now for free

06.

Tax change in 2022: Higher minimum wage

The minimum wage will be increased to EUR 9.82 per hour from January 1st, 2022. Another increase is planned for July 1, 2022 and will increase the minimum wage for an hour’s work by 63 cents to 10.45 euros.

This regulation also applies to mini jobs , which is why the number of hours may have to be adjusted. The reason for this is that mini-jobs have an upper limit for monthly earnings.

07.

Maximum duration of short-time work benefits

The legislature decided to extend the maximum period for which short-time work benefits (Kurzarbeitergeld) can be paid. This is 24 months and after the new tax changes, it’s no longer limited to the end of 2021, but extended to March 31, 2022.

Your advantages

Taxes without forms: Answer our easy-to-understand question-answer process, or have your tax done by an independent tax advisor.

The best way to do your taxes

The choice is yours: complete the simple question and answer process, or use Expert Service and have your taxes done for you by an independent tax advisor. Either way, you can avoid complicated tax jargon.

Learn morePaperless document upload

Taxfix makes your tax return completely digital. Simply photograph or upload your documents. Taxfix then automatically transfers all important information - accurately and stress-free!

Learn moreGet an estimated tax refund quickly

We tell you how much you get from the tax office. Not only do we automatically deduct flat rates that you can use to save taxes, we also show you transparently what information you submit.

Learn moreCompletely secure

Your data is always transmitted in encrypted form to the Taxfix servers and via ELSTER to the tax office. We use secure encryption technologies that are also used by banks.

Learn more08.

Extension of the home office fixed deduction (Homeoffice-Pauschale)

The home office fixed deduction, used by people who have to work from home and do not have a separate study, can also be claimed in the 2022 tax year. The new government is already planning to make this a permanent fixed deduction.

In the future, too, 5 euros per day can be claimed for tax purposes for a maximum of 120 days per year.

You can find more about this in the article on study and home office .

09.

Fixed deposit for relocation expenses (Pauschale Umzugskosten)

As usual, the fixed deductions for professional relocations (Pauschale Umzugskosten) have changed. Since the topic was reformed in 2020, this now always happens on the deadline of April 1st. According to the Federal Relocation Costs Act (BUKG), the day before loading the removal goods is decisive for which fixed deductions apply. The fixed deduction for other relocation costs (“Relocation costs fixed deductions”) amounts to EUR 870 for the taxable person moving between January 1, 2022 and March 31, 2022 and and EUR 886 if you move after April 1st, 2022.

For spouses, unmarried children, stepchildren and foster children who live with the entitled person in a domestic community even after the move, the following values apply per person: until March 31, 2022: 580 euros, from April 01, 2022: 590 euros.

Tuition: If you move after March 31, 2022, you can claim a maximum of EUR 1,160 as extra tuition per child; if you move after April 1, 2022, it is EUR 1,181.

10.

Minimum for purely electric range of e-cars or plug-in hybrids

So that plug-in hybrids and other electric vehicles can benefit from an advantageous taxation, they may emit a maximum of 50 grams of CO₂ per kilometer. An alternative criterion until the end of 2021 was a minimum all-electric range of 40 kilometers. From the beginning of 2022, the minimum range requirement will be increased to 60 kilometers.

It is sufficient to meet one of the two criteria for the more favourable taxation to be possible. From 2024, in addition to the 50 gram rule, a minimum range (purely electric) of 80 kilometers will be a requirement.

11.

Pension expenses (Vorsorgeaufwendungen) for old age

Pension expenses can be claimed as special expenses in the tax return. From 2022, the maximum amount for contributions to the Rürup pension insurance will be EUR 25,639, of which up to 94% can be deducted. Singles can thus claim EUR 24,101 and jointly assessed couples, EUR 48,202 for tax purposes.

A deductible percentage of 94% sounds good, but to be honest it has to be said that this is only 88% due to peculiarities in the calculation of the deductible amount. For example, if you pay EUR 3,000 in contributions to statutory pension insurance and your employer does the same, an amount of EUR 2,640 will be taken into account as a special expense.

This value is based on the following calculation:

3,000 euros employee + 3,000 euros employer = 6,000 euros

6,000 euros * 94% = 5,640 euros

5,640 euros – 3,000 euros (the employer’s full share) = 2,640 euros

According to the current status, these contributions will be 100% deductible from 2025. However, the current federal government has already announced that this will be brought forward to 2023. However, there is still no corresponding decision on this change.

12.

Tax change 2022: Subsidy for old-age provision

A tax change in 2022 affects the contracts for old-age provision that were entered into together with the employer. Previously, 15% was only paid for contracts concluded from 2019 onwards. This has now been extended to old contracts (i.e., those that were concluded before 2019.

The full subsidy is available for people whose income is below the contribution assessment limit for statutory health insurance — in 2022 it will be 58,050 euros. Persons who have higher earnings receive a progressively reduced subsidy.

13.

Tax exemption for company pension schemes

Provided that an employee intends to invest Christmas or vacation pay in a company pension scheme that is realized through direct insurance, a pension fund or a pension fund, contributions from 2022 up to a maximum of 6,768 euros are permitted to be tax-exempt.

We have already recovered over 3 billion euros for our customers! Taxfix's mission is to enable financial participation for everyone.

Tax experts work at Taxfix.

Employees counts Taxfix currently.

14.

Home expenses as extraordinary burdens (außergewöhnliche Belastungen)

Home costs can be claimed as an extraordinary tax burden if the need for care is the reason for living in the home.

However, this amount is reduced by the so-called household savings (Haushaltsersparnis). This is a maximum of 9,984 euros for the year 2022, but decreases with each day that has not yet been lived in the home.

15.

Tax change 2022: The old-age relief amount (Altersentlastungsbetrag)

The old age relief amount (see end of the linked article) applies from the age of 64, reduces the tax burden and affects all income, with the exception of pensions and annuities. It is deducted from the total of the associated income. From this follows the total amount of income.

From 2022, the percentage that will be deducted from the total income will be 14.4%, with a maximum of 684 euros. It is thus 0.8 percentage points below the value for the previous year. By 2040, the old-age relief amount will be gradually reduced to 0%.

16.

Determination of the pension allowance (Rentenfreibetrags)

If the date of retirement is in 2022, the pension exemption amount will be determined exactly twelve months later (i.e., in 2023). This is quoted at 18% of the gross pension and is defined by the tax office. This allowance for pension contributions then applies until the end of life.

In the case the pension increases, this handling can lead to the fact that the tax-exempt amount remains the same and that income tax becomes due.

17.

Tax-filing obligation for working students: New wage limit

Working students are often surprised when we tell them that they’re obligated to submit a tax return. In fact, many working students meet certain criteria, which lead to the obligation to submit a tax return, failing which there may be negative consequences.

The background to this obligation to pay is a supposedly inconspicuous value on the annual payslip called the minimum pension flat rate (Mindest-Vorsorgepauschale) in line 28. This shows the tax office that a fictitious value for other pension expenses was used when determining the income tax to be withheld.

If the actual pension expenses are below the pension fixed deduction taken into account and the annual income is above a statutory limit, a tax return must be submitted.

Since the minimum pension fixed deduction applies not only to students but to all employees who are not fully subject to social security contributions, it is quite high at around 1,900 euros per year. With contributions to student health and nursing care insurance alone, you are well below this amount, and as a student you rarely have high costs for other insurances.

The good news is that the legal threshold for annual income has been raised again for 2022 and is now EUR 12,550. If you earn less than this amount, you don’t have to file a tax return, but it’s often worth it anyway. If, on the other hand, the income is above the amount, depending on the individual deductible pension expenses, there may be an obligation to submit a tax return and the corresponding deadlines apply.

Scan your payslip, and you're done!

It's so simple and completely digital: photograph or upload your documents. Taxfix then automatically transfers all important information. Accurately and stress-free!

Start now for free18.

From 2022: Revoked relief for taxpayers

One or the other simplifications for taxpayers will no longer exist in 2022. The reason such relief was introduced was the COVID-19 pandemic. One aspect that was designed with more consideration was the deferrals and instalment arrangements that could be negotiated with the tax office. These are expected to end in early 2022.

19.

Support services for adult children are deductible

If parents no longer claim parental allowance for their adult child, but continue to support the children, the corresponding costs can be claimed for tax purposes as support services (Unterstützungsleistungen). In the tax year 2022 (i.e., in the tax return that can be submitted from 2023) the maximum amount for this is 9,984 euros.

This value can only be higher if the parents also pay contributions to private health and long-term care insurance, but the sum is also reduced by the child’s payments that are over 624 euros in 2022. Likewise, the child must not have more than 15,500 euros in assets, otherwise, the costs are not allowed to be deducted at all.

These provisions also apply if the children support their parents, i.e., if the situation is reversed.

20.

Reduced loss carryforward and carryback possibilities (Verlustvortrags- und -rücktragsmöglichkeiten)

For the tax years 2020 and 2021, there were increased opportunities to carry forward and carry back losses . It was possible to have loss carry forwards or loss carrybacks (individual/joint assessment) of ten or 20 million euros taken into account for taxes.

From the 2022 tax year, these values will be reduced again to the previous regulation of one or two million euros (depending on the assessment).

21.

Forecast for tax changes 2022: Property tax reform 2022

The Property Tax Reform Act stipulates that all properties nationwide are to be revalued by January 1, 2022. As part of the revaluation, all owners of their property must submit a digital declaration to determine the property tax value – regardless of whether they are owner-occupied or rented out. Submission is possible from July 2022. We will have more information on this subject in due course.

22.

New tax regulations for 2022: Already thought through

The Taxfix tax app always includes the current standard amounts, exemption limits and changed maximum values when calculating your taxes. So you don’t have to worry about observing changes in tax law or researching them extensively when filing your tax return with us.

With the plausibility check and the question-and-answer procedure, the Taxfix tax application is reliable and allows you to create the tax return in a time-efficient manner. We also consider ways to have further tax deductions for you, and some even say that filing your tax return with the tax office is fun with the Taxfix app!

Try it now and get your expected tax refund calculated for free. Based on the calculation, you then decide whether you want to submit it via the secure ELSTER interface or not.

Always up to speed: All tax changes have already been implemented in the Taxfix app.

Start your tax return.

Our experts

You're in good hands

Our team of tax experts has years of experience helping people like you with your taxes.