Werbungskosten: How are Tax-Deductible

Income-related expenses are all the costs directly related to your work. Although expenses, these are necessary for you to carry out your work.

If you pay contributions to a professional association, you can deduct these as Werbungskosten from tax. Professional associations include:

- Trade Unions

- Professional Associations

- Chamber of Crafts

- Medical Association

- Bar Association

- Association of Tax Advisors

- Chamber of Architects

- Official Association

- Judges' Association

If you are involved in educational and training programs that benefit your professional career and maintain your income, they are counted as Werbungskosten. In many professions, you need to update your knowledge base constantly. You can therefore deduct the costs for the advanced training as income-related expenses from the tax.

01.

What are "Werbungskosten"? A definition of income-related expenses

According to Section 9, Paragraph 1, Clause 1 of the Income Tax Act, income-related expenses (Werbungskosten) are ‘expenses for acquiring, securing, and maintaining income’. For instance, you may need a car to drive to work, need your own toolkit on the job, invest in advanced training, or even move to a new city for work. These are expenses that allow you to secure, maintain, and earn your income as an employee. In simple terms, these are your income-related expenses.

The tax office is aware that income-related expenses are necessary for every job. For this reason, it provides each employee with an annual ‘Arbeitnehmerpauschbetrag’ or fixed allowance for employees. A sum of 1,230 Euros are automatically declared as non-taxable income for an employed person. This sum increases to for jointly assessed married couples and registered partners.

To have considerable savings when filing your tax return, you need to claim income-related expenses that exceed the fixed allowance for employees. Lucky for you, there’s plenty to deduct!

Here is a list of the most common income-related expenses that you can deduct from tax:

Prepare your own tax return

From €39.99

Free until your refund calculation – then from €39.99 for submission.

Receive an advance calculation of your refund and pay only when you turn it in

Guided and intuitive process with simple questions

Automatic data retrieval: simply retrieve your income data from the tax office and have it pre-filled

The general deadline applies (July 31st)

€59.99 for married couples or registered partnerships looking to file a tax return together

Save money and secure exclusive benefits with Taxfix+

Get your tax assessment for free and only pay when you submit your return

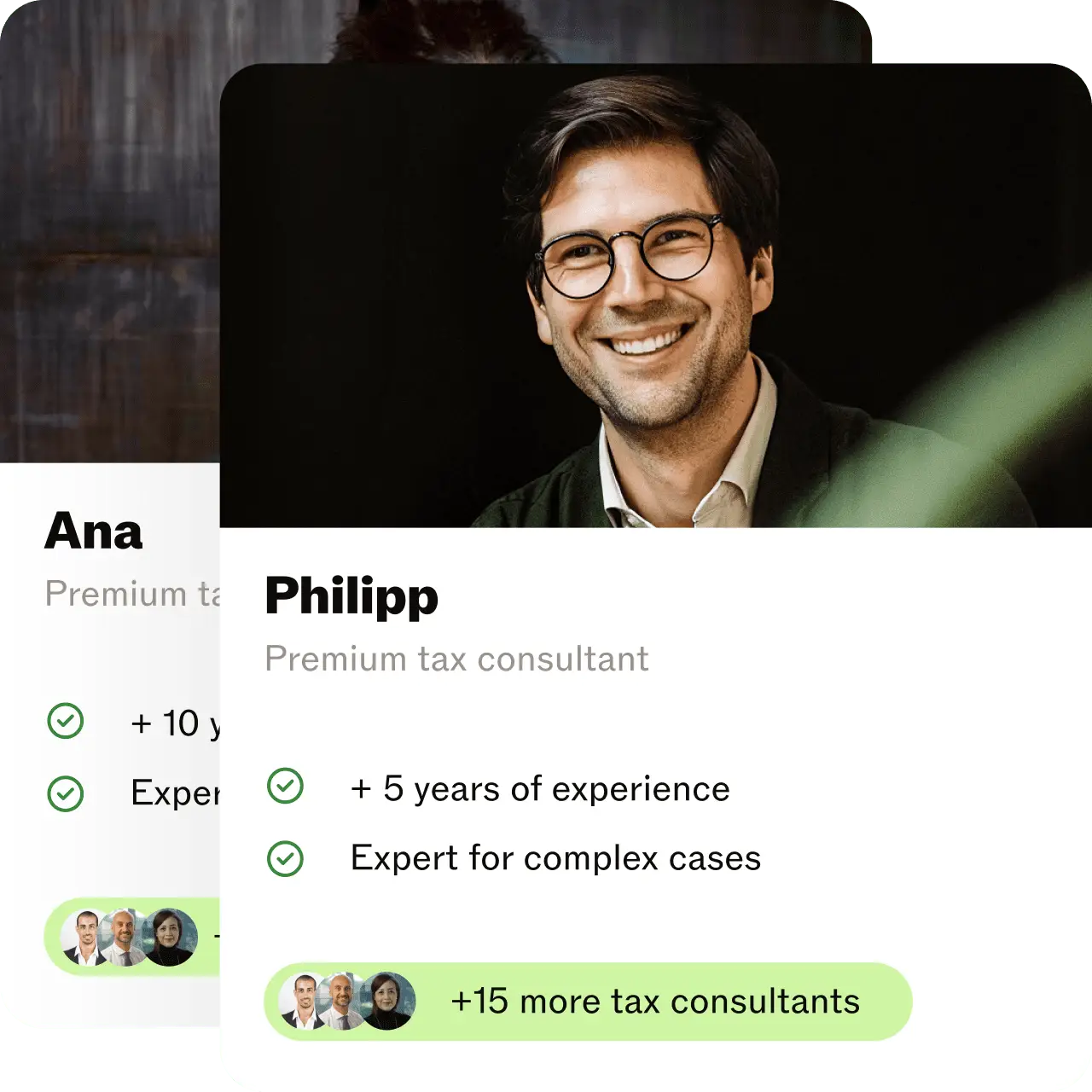

Our Expert Service does it for you

From €99.99

20% of your refund (minimum fee: €99.99).

Provide a few necessary documents in minutes

An independent tax advisor will prepare your tax return for you

Personalised document upload: Only submit documents that are completely necessary

Detailed check of your information

Benefit from an extended tax deadline (April 30th, 2026)

Hand over, pay, relax.

02.

Work Equipment Costs

Any object that you use for work is considered a tool or ‘Arbeitsmittel’. You can deduct these as Werbungskosten from your tax return. Here’s what counts as Arbeitsmittel:

- Workwear

- Office supplies

- Specialist literature

- Computer

Attention:

If a piece of work equipment exceeds the amount of 952 Euros (including sales tax), the cost for this item is written off over the specified duration of its use. There are some exceptions, though! One is deducting a computer: Find information around this in our German and updated article on how to deduct a computer .

03.

Moving Costs (Umzugskosten)

If you move for work, you can deduct the costs of your move as Werbungskosten from tax. The condition is that you should have saved at least one hour of daily commuting time because of your move.

The moving costs include:

- Travel expenses to view the apartment

- Transportation costs

- Repairs in the event of transportation damage

- Brokerage costs

- Re-registering the car

- Renovation of the old apartment

04.

Travel Expenses on a Business Trip

If you are on a business trip, you can claim your costs for travel, meals, and accommodation as Werbungskosten. Typical business trips include visits to customers or trade fairs.

- You can set the travel costs at EUR 0.30 per kilometre with the kilometre flat rate. But the exact travel costs can also be deducted with receipts.

- The meals are covered by the food allowance (Verpflegungspauschale).

- In the case of accommodation, you state the costs for the overnight stay, excluding meals, as the meal allowance already covers these. You can also deduct other incidental travel expenses (like parking fees) as Werbungskosten.

Scan your payslip, and you're done!

It's so simple and completely digital: photograph or upload your documents. Taxfix then automatically transfers all important information. Accurately and stress-free!

Start now for freeYour advantages

Taxes without forms: Answer our easy-to-understand question-answer process, or have your tax done by an independent tax advisor.

The best way to do your taxes

The choice is yours: complete the simple question and answer process, or use Expert Service and have your taxes done for you by an independent tax advisor. Either way, you can avoid complicated tax jargon.

Learn morePaperless document upload

Taxfix makes your tax return completely digital. Simply photograph or upload your documents. Taxfix then automatically transfers all important information - accurately and stress-free!

Learn moreGet an estimated tax refund quickly

We tell you how much you get from the tax office. Not only do we automatically deduct flat rates that you can use to save taxes, we also show you transparently what information you submit.

Learn moreCompletely secure

Your data is always transmitted in encrypted form to the Taxfix servers and via ELSTER to the tax office. We use secure encryption technologies that are also used by banks.

Learn more05.

Second Home Costs

If you have a second home at your place of work for professional reasons, you can deduct the expenses for double-housekeeping (doppelte Haushaltsführung) as Werbungskosten. Concrete costs include:

- Rental fee

- Second residence tax

- Travel expenses for the trip home

- Costs for necessary furnishings

- Moving costs

06.

Application Costs (Bewerbungskosten)

If you change your job or are looking for a job, you can deduct the expenses for applications (Bewerbungskosten) as Werbungskosten. These costs include:

- Paper

- Envelope

- Postage

- Travel expenses to the job interview

However, flat rates are also considered as follows:

- Application folder: 8.50 Euros

- Online application: 2.50 Euros

07.

Contributions to Professional Associations

If you pay contributions to a professional association, you can deduct these as Werbungskosten from tax. Professional associations include:

- Trade Unions

- Professional Associations

- Chamber of Crafts

- Medical Association

- Bar Association

- Association of Tax Advisors

- Chamber of Architects

- Official Association

- Judges’ Association

08.

Training costs

If you are involved in educational and training programs that benefit your professional career and maintain your income, they are counted as Werbungskosten. In many professions, you need to update your knowledge base constantly. You can therefore deduct the costs for the advanced training as income-related expenses from the tax.

Our experts

You're in good hands

Our team of tax experts has years of experience helping people like you with your taxes.