Lohnsteuerbescheinigung: How is the annual payslip relevant to my tax return?

The income tax certificate is more than a simple annual statement. It helps you with your tax return and shows what was deducted from your gross salary in the previous year. Here’s why you need to keep your income tax statement safe and secure.

Quick navigation

01.

Annual Statement (Jahresabrechung) as Annual Payslip (Lohnsteuerbescheinigung)

Every year you receive a printout of the annual payslip from your employer. As you go through it, you’ll find important information like your tax deductions, social security contributions, gross wages, and additional amounts that your employer has already paid via the monthly payslip.

Prepare your own tax return

€39.99

For anyone who wants to file an easy and secure tax return themselves. Free refund calculation, pay only upon submission.

Receive an advance calculation of your refund and pay only when you turn it in

Guided and intuitive process with simple questions

Automatic data retrieval: simply retrieve your income data from the tax office and have it pre-filled

The general deadline applies (September 02)

€59.99 for married couples or registered partnerships looking to file a tax return together

Get your tax assessment for free and only pay when you submit your return

Our Expert Service does it for you

From €89.99

For those who are unsure or can't find the time – hand your taxes to an expert.

Provide a few necessary documents in minutes

An independent tax advisor will prepare your tax return for you

Personalised document upload: Only submit documents that are completely necessary

Detailed check of your information

Benefit from an extended tax deadline (June 2nd, 2025)

Hand over, pay, relax.

02.

The Annual Payslip in Detail

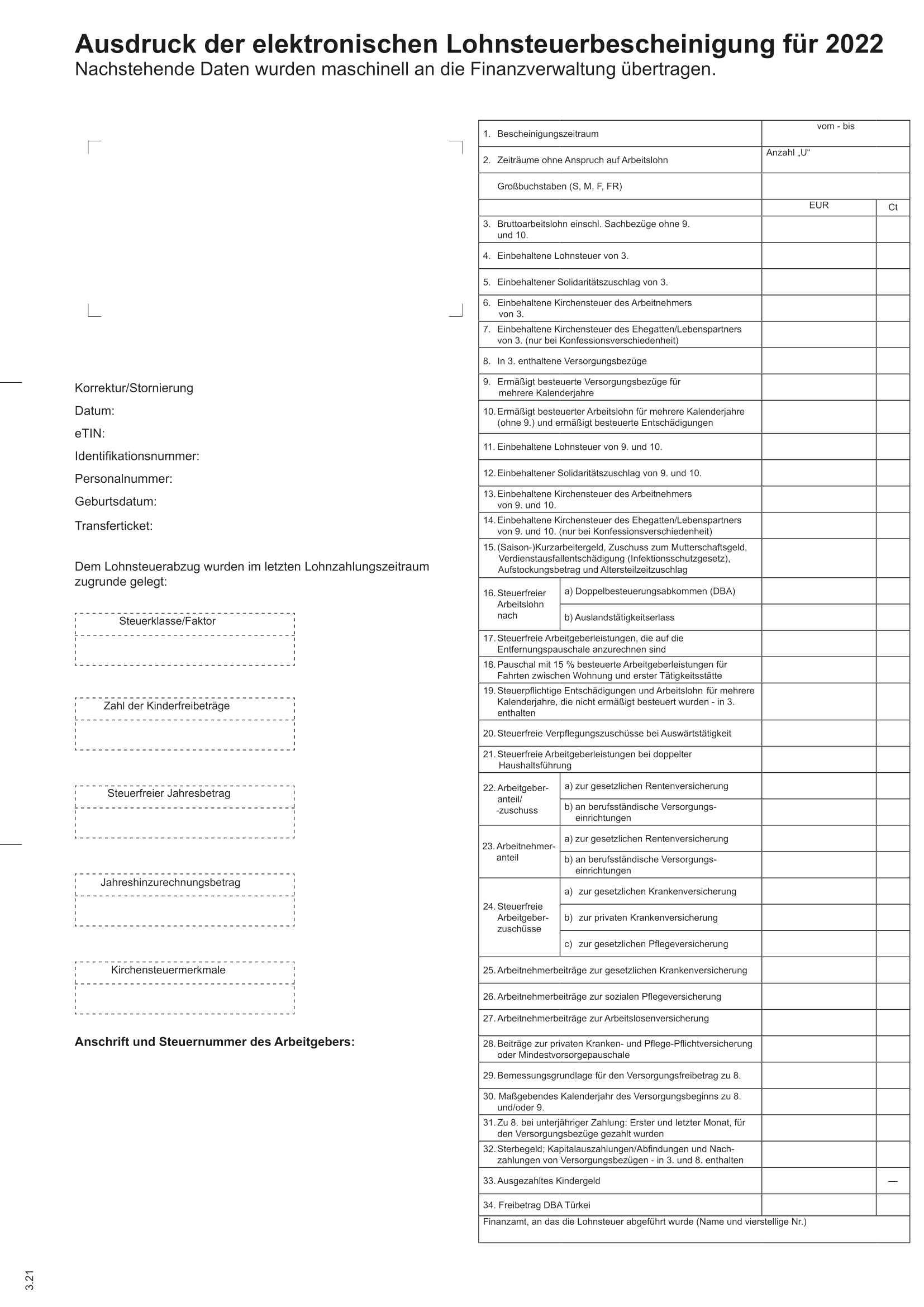

Auf dem Ausdruck findest du übersichtlich auf 2 Spalten viele Informationen zu deinem Einkommen und deinen persönlichen Steuermerkmalen:

- The eTIN, which is your personal electronic transfer identification number. It is important for data comparison and data transfer with the tax office.

- Your tax identification number (Steuer-Identifikationsnummer)

- Personnel number (Personalnummer) from the personnel department

- Date of birth

- Tax class

- Childcare allowances (Kinderfreibeträge)

- Your employer’s address and tax number

- Gross income

- Information on withheld income tax, solidarity surcharge, and church tax

- Contributions to health, pension, long-term care, and unemployment insurance

- Child benefit (Kindergeld) that was paid to you

You will also find a column in your annual payslip on short-time work allowance (Kurzarbeitgeld). If you would like to receive more information on how Kurzrbeitgeld can affect your taxes, read this article .

What the annual payslip for 2022 looks like:

Got your annual payslip? File your taxes easily and securely with Taxfix and claim your refund!

Hint:

Mini-jobs don’t usually help you get an annual payslip because social security contributions and wage tax are not paid.

Scan your payslip, and you're done!

It's so simple and completely digital: photograph or upload your documents. Taxfix then automatically transfers all important information. Accurately and stress-free!

Start now for free03.

When do you receive your annual payslip?

Taxable employees should receive their annual payslips from employers anytime between December and February of the following year. If there are delays, consult your employer.

If you resign from a company during the year, (in many cases) your former employer will send you the annual payslip earlier than usual. If you have received unemployment benefit (Arbeitslosengeld) for any duration during the tax year, you’ll also receive it from the employment office as a payroll tax statement (Lohnsteuerabrechnung). This usually arrives by the end of February.

04.

Printout of the annual payslip for tax returns

The printout of the annual payslip not only gives you an overview of the benefits and deductions that you had in the past year, but is also very helpful when preparing your tax return. This is because the values from your wage tax statement and your other deductible expenses as well as various income streams determine the amount of tax refund you can expect.

Your annual payslip, therefore, greatly simplifies the preparation of your tax return. But be careful: it’s tempting to merely assume these values and send off the tax return prematurely in order to save yourself work. Many taxpayers secure incorrect refunds when their income-related expenses and special expenses are not stated in full.

Special expenses:

In contrast to income-related expenses, special expenses are various costs that are legally considered to be related to your private life management – for example pension expenses, health insurance, or … Read more.

05.

Missing or incorrect information in your annual payslip

If you have not received your income tax certificate or cannot find yours, you can simply ask your office HR department for it. If there are mistakes, you should discuss them with your employer and note them in your tax return.

Errors that are shown to the tax office must be proven. Don’t worry: the annual paysli[ serves as a guide for the tax return, but only the tax return itself and the subsequent tax bill from the tax office are legally binding. This makes it easy to fix errors.

Tip:

With an ELSTER account , you can see which documents your employer has sent to the tax office.

06.

Safeguard your annual payslip!

You should file your annual financial statements, i.e. the printouts of your annual electronic Lohnsteuerbescheinigung, together with your annual tax assessments and keep them until you retire. In the foreseeable future, you may need this to supplement your tax assessment, as proof for the care of relatives, for the application for parental allowance, booking a place in the Kita, the child’s BAföG application, and other applications.

In the long run, however, the printouts could also be useful in calculating your pension, for example, to contest a pension entitlement. Read this guide to know which documents to retain and for how long.

Taxfix guides you to file a correct and secure tax return using a simple question-and-answer process, via app or browser!

About Taxfix

With Taxfix, you can complete your tax returns from 2019-2022, in no time at all. No tax knowledge is necessary – simply choose to complete your Taxfix tax return yourself, or have an independent tax advisor do it for you. What are you waiting for?

Start now