Mandatory tax filing: Who’s obligated to file tax returns?

In this article, we tell you who's required to file a tax return and what you have to bear in mind if you were affected by short-time work (Kurzarbeit) or unemployment in 2021. Bear in mind: In most cases, it's worth filing a voluntary tax return.

01.

Tax obligation in Germany: Who has to file a mandatory tax return?

Almost everyone in Germany pays taxes. They surround us in everyday life and often run in the background. When you go shopping, you pay sales tax or VAT. Do you have a car? Then you pay vehicle tax . Even a dog entails taxes!

If you earn money in Germany, you usually have to pay income tax. How much you have to pay depends on the income you earn over the year. It is only at the end of the year that you know what you have to pay in taxes and what you have to pay to the state. But the tax office doesn’t want to wait that long for its money.

Consequence: You already pay tax regularly throughout the year.

Are you employed? Then, your employer deducts income tax from your salary every month. The amount is shown as wage tax (Lohnsteuer) on your payslip. The wage tax is, therefore, nothing more than a regular advance payment for your income tax.

As an employee with one fixed employer, your taxes are taken care of, at least in most cases. Only when you have additional income or have certain combinations of income tax classes or other special circumstances, do you have to go dig deep into your taxes.

Prepare your own tax return

From €39.99

Free until your refund calculation – then from €39.99 for submission.

Receive an advance calculation of your refund and pay only when you turn it in

Guided and intuitive process with simple questions

Automatic data retrieval: simply retrieve your income data from the tax office and have it pre-filled

The general deadline applies (July 31st)

€59.99 for married couples or registered partnerships looking to file a tax return together

Save money and secure exclusive benefits with Taxfix+

Get your tax assessment for free and only pay when you submit your return

Our Expert Service does it for you

From €89.99

20% of your refund (minimum fee: €89.99).

Provide a few necessary documents in minutes

An independent tax advisor will prepare your tax return for you

Personalised document upload: Only submit documents that are completely necessary

Detailed check of your information

Benefit from an extended tax deadline (April 30th, 2026)

Hand over, pay, relax.

02.

Does everyone have to file a tax return?

In principle, everyone with a taxable income must file an income tax return. Only in certain cases are you exempt from this obligation.

If you are an employee, however, there is a good chance that you will not have to file a tax return because your tax liability is settled by paying wage tax on a regular basis. This is calculated on the basis of your tax bracket so that you don’t pay too little tax, on this part of your income.

But even for employees, the wage tax alone is not always enough to cover the tax liability. We will describe such cases in a moment.

On the other hand, you can also use your tax return to get back money that the state is not entitled to. If you are one of those people who do not have to pay their taxes, you can still voluntarily file a tax return, for example for the year 2021. It’s a good idea to file your tax return because in many cases, you’re granted a refund.

Note

The tax office does not necessarily send you a request. It’s falls on you to find out if you’re a mandatory tax filer.

03.

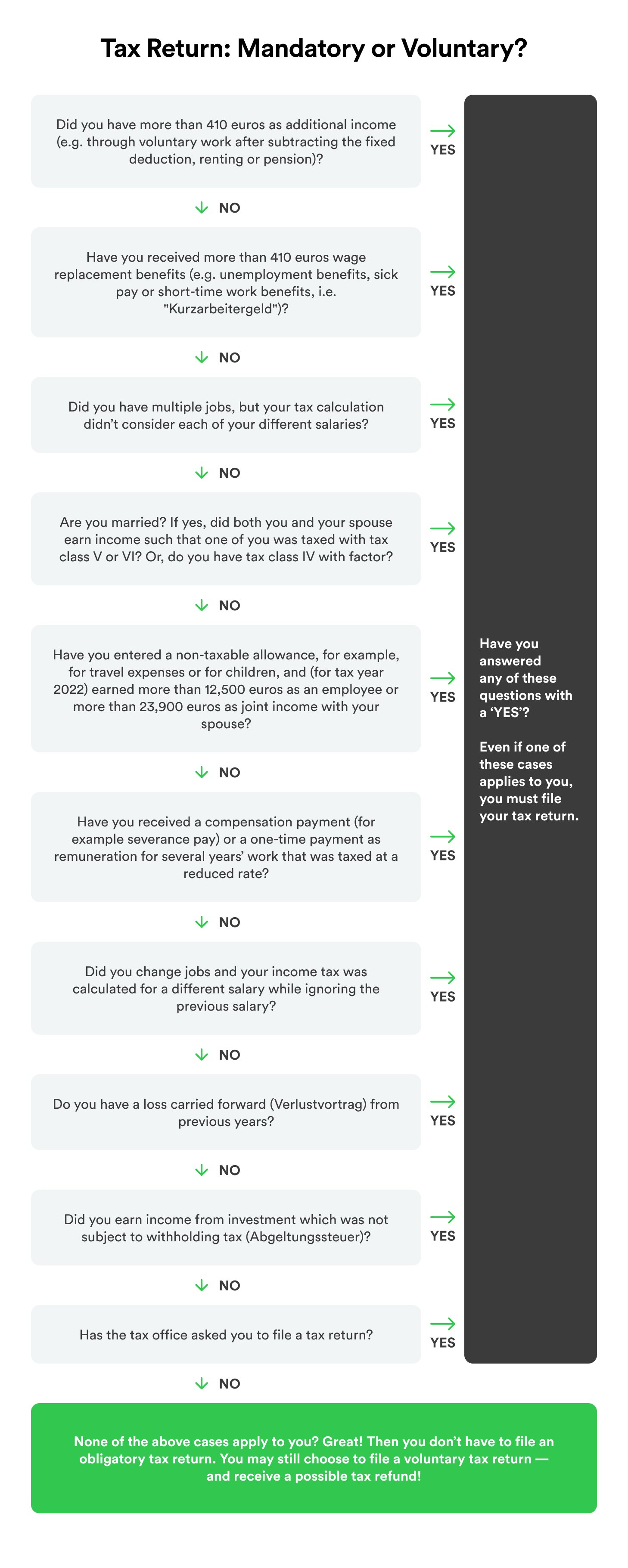

Who has to file an obligatory tax return? This checklist holds the answer

Here it is again in full: Our checklist for compulsory tax returns explains whether you have to file a tax return:

* You can find details on short-time work benefits in our article .

Once more, let’s go over the checklist and confirm if you are obligated to submit a tax return.

- You received more than €410 in other income (e.g. self-employment or commercial activity, rental or pensions)

- You have received more than €410 of wage replacement benefits (e.g. unemployment benefits, sick pay or short-time work benefits

- You were employed by more than one employer at the same time and the income tax was not added up for both salaries

- You are married and you both received wages, one person was taxed in tax class V or VI, or you have tax class IV with a factor

- You have entered an allowance for travel expenses or children, for example, and you earn more than €12,550 (2022) as an employee or more than €23,900 for married couples who are assessed together

- You received a compensation payment (e.g. severance pay) or a one-off payment as remuneration for a multi-year activity that was taxed at a reduced rate

- There was a change of employer and the wage tax for another payment was calculated without the previous salary (“S” in the wage tax statement in the line “capital letters”)

- You have a loss carried forward from previous years

- You had capital gains on which no withholding tax was paid

- You have been asked by the tax office to submit a tax return

We explain the individual points in more detail below:

When you earn more than 410 euro as side-income

Do you have taxable additional income like income from renting or from self-employment? Or do you receive income from abroad (non-German income)? Then you have to state this in the income tax return if your total income from such sources exceeds 410 euros per year.

More than 410 euros in income-replacement benefits (e.g. unemployment or short-time work benefits)

Maybe you were or are affected by short-time work (Kurzarbeit) due to the corona pandemic. If you have received more than 410 euros in short-time work benefits (Kurzarbeitgeld) throughout the year, regardless of how long you worked as a short-term worker (Kurzarbeiter) you are subject to tax. The same applies to the other wage replacement benefits, such as unemployment benefit I, parental benefit or sick pay.

Tip

We’ve optimised Taxfix app for short-time work and unemployment benefits. Home office and other fixed deductions are also automatically queried in the app so that you get the most out of it.

Two or more simultaneous employers

If you have several sources of income simultaneously, an employer will issue you an income tax certificate with tax class VI. You are then obligated to pay taxes.

Civil partnerships with tax class IV/IV with factor or III/V

If you and your spouse or registered life partner have chosen the combination of tax classes IV/IV with a factor or III/V , you are obliged to submit a tax return – but only if the partner in tax class V has received wages.

The same applies if you opt for individual assessment, and you have not applied for half of the training allowance or half of the disability allowance for your child .

The compulsory assessment also applies to divorced or widowed persons who remarry in the same year.

04.

Fixed Allowance (income tax reduction)

Have you submitted an application for an income tax reduction to your responsible tax office and entered a fixed deduction? Then you’re obligated to prove your actual income-related expenses or special expenses (Sonderausgaben) in the tax return.

There is no obligation only for these exceptions:

- In the case of lump sums for the disabled, survivors or the tax credit for single parents.

- If you earned less than EUR 12,550 (EUR 23,900 for married couples filing jointly) in 2022.

Scan your payslip, and you're done!

It's so simple and completely digital: photograph or upload your documents. Taxfix then automatically transfers all important information. Accurately and stress-free!

Start now for freeYour advantages

Taxes without forms: Answer our easy-to-understand question-answer process, or have your tax done by an independent tax advisor.

The best way to do your taxes

The choice is yours: complete the simple question and answer process, or use Expert Service and have your taxes done for you by an independent tax advisor. Either way, you can avoid complicated tax jargon.

Learn morePaperless document upload

Taxfix makes your tax return completely digital. Simply photograph or upload your documents. Taxfix then automatically transfers all important information - accurately and stress-free!

Learn moreGet an estimated tax refund quickly

We tell you how much you get from the tax office. Not only do we automatically deduct flat rates that you can use to save taxes, we also show you transparently what information you submit.

Learn moreCompletely secure

Your data is always transmitted in encrypted form to the Taxfix servers and via ELSTER to the tax office. We use secure encryption technologies that are also used by banks.

Learn more05.

Change of employer ('S' in the annual payslip or 'Lohnsteuerbescheinigung')

Have you changed jobs within a year and received special payments such as a Christmas bonus? It’s possible that your new employer did not take the values of the previous employer into account when calculating your income tax. In this rare case, you will find the letter ‘S’ on your annual payslip (Lohnsteuerbescheinigung) .

06.

Loss carried forward (Verlustvortrag)

You also have to pay the tax if you have a tax loss from previous years. This minus is then offset against your taxable income.

07.

Hitherto untaxed capital gains

If your investment income from the sale of securities (e.g. shares), interest or dividends was more than 801 euros and the bank has not yet taxed you for it, likely because it was generated in foreign accounts, you must state this for tax purposes.

Obligatory or voluntary, Taxfix is the perfect tool for your tax return. File taxes error-free and efficiently. Start for free

Tip

By giving your bank an exemption order in good time, you can prevent the deduction of withholding tax. The savings allowance is a maximum of EUR 1,000 (EUR 2,000 or married couples) per year. You can distribute this to several banks. You have to pay tax on higher capital gains.

08.

Who is obligated to file a tax return?

You are not obligated to file an income tax return in these cases:

- You are in tax class I and only had income from one employer.

- You are married/in a registered civil partnership, have the combination of tax classes IV/IV and only income as an employee.

09.

Need help?

Hopefully, you now have all the information you need to file your tax declaration and claim your maximum refund. Remember, Taxfix is here to make your tax return as easy as possible. Start for free in our app, which averages +4.5 ratings and is also available in English !

Our experts

You're in good hands

Our team of tax experts has years of experience helping people like you with your taxes.