Tax returns for people with disabilities

The state compensates for the financial burden of medication and care. You have these control options.

Table of contents – tax return for people with disabilities

01.

The disability allowance

The lump sum for disabled people makes it possible to (partially) compensate for the financial burden of the disability. It depends on the severity of the impairment, which must be certified by a doctor.

The tax benefits apply to both adults and children from a tax point of view. More to Tax return with a disabled child (German) we have collected in a separate post.

The amount of the disability allowance

The following tables show which amounts you are entitled to for which degree of disability. In addition, there is a mark that refers to your limitation.

The marks are on the disability card and show which disability a person has. For example:

- Bl for blind

- H for helpless

- aG for exceptionally handicapped people

- G for significantly disabled walking and standing

If this is very pronounced and, for example, an H like "helpless" or a "Bl" like "Blind" is noted, the amount to which you are entitled can be significantly higher.

In order to be able to claim the disability allowance in your tax return, you need a certificate from the pension office. From a degree of disability (GdB) of 50 you will be issued with a severely disabled pass. You should definitely submit a copy of the document with the first tax return in which you want to have the flat rate credited .

degree of disability (Grad der Behinderung) | disability allowance |

20 | €384 |

30 | €620 |

40 | €860 |

50 | €1,140 |

60 | €1,140 |

70 | €1,780 |

80 | €2,120 |

90 | €2,460 |

100 | €2,840 |

For helpless, blind or deaf-blind people | €7,400 |

degree of disability (Grad der Behinderung) | Amount of the disability allowance |

25-30 | €310 |

35-40 | €430 |

45-50 | €570 |

55-60 | €720 |

65-70 | €890 |

75-80 | €1,060 |

85-90 | €1,230 |

95-100 | €1,420 |

For helpless, blind, deaf-blind or people in dire need (schwerst-bedürftige Menschen) | €3,800 |

02.

More expenses than the fixed deduction cushions?

The lump sum can be used to cushion your permanent costs, such as medication or regular therapies.

But if these lump sum (German) far exceed or one-off expenses, such as a cure, certain necessary purchases or the wheelchair-accessible conversion of your home, you can enter further items as extraordinary expenses.

However, these are only taken into account if they acceptable load limit (German) exceed. The tax office determines this as a percentage based on income, marital status and number of children.

How are exceptional charges claimed?

- First of all, it is important to determine how high the extraordinary loads are. To do this, you add up the values of the expenses that count as such expenses for tax purposes. We'll tell you what they are in the Guide contribution Extraordinary load (German).

- You reduce the amount by the reasonable burden (see next section).

- You enter the extraordinary in one of two ways in the tax return

Please note:

Taxfix works via smartphone app or browser application. You can get your correct tax return in unter einer halben Stunde, receive an estimate of your tax result free of charge, and then submit it to the tax office conveniently and securely!

Prepare your own tax return

€39.99

For anyone who wants to file an easy and secure tax return themselves. Free refund calculation, pay only upon submission.

Receive an advance calculation of your refund and pay only when you turn it in

Guided and intuitive process with simple questions

Automatic data retrieval: simply retrieve your income data from the tax office and have it pre-filled

The general deadline applies (September 02)

€59.99 for married couples or registered partnerships looking to file a tax return together

Get your tax assessment for free and only pay when you submit your return

Our Expert Service does it for you

From €89.99

For those who are unsure or can't find the time – hand your taxes to an expert.

Provide a few necessary documents in minutes

An independent tax advisor will prepare your tax return for you

Personalised document upload: Only submit documents that are completely necessary

Detailed check of your information

Benefit from an extended tax deadline (June 2nd, 2025)

Hand over, pay, relax.

How to calculate your reasonable stress limit ("Zumutbare Eigenbelastung")

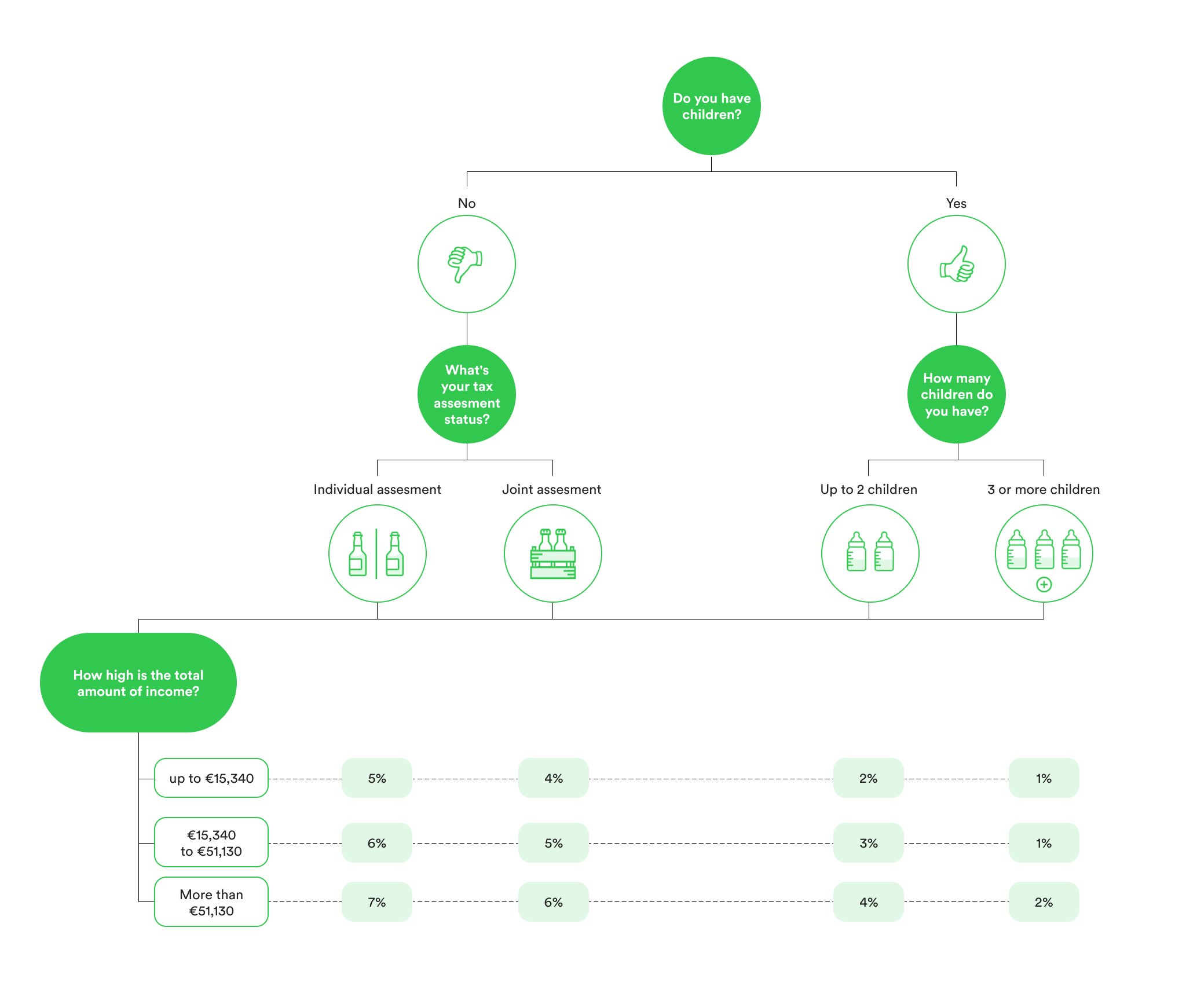

With the help of the following graphic you can determine your personal reasonable stress limit. With a simple calculation you get the value, which depends on the number of children and the possible joint assessment with your partner.

Tipp:

For example, are you single and childless (German) and have a total annual income of 15,000 euros, the limit is 5 percent of that. What goes beyond medical expenses, dental bills, co-payments may be deducted. It is important that the costs were based on a doctor's prescription.

Claiming trips as exceptional burden – how to do that

Another point that can be considered an exceptional burden is travel. For example, if your degree of disability is over 80, you can submit private trips up to a distance of 3,000 kilometers per year. With a corresponding mark (Bl, aG or H) it can even be up to 15,000 kilometers, which should be proven in a logbook.

Taxfix-Tipp:

For business trips, people with a GdB (degree of disability) of more than 70 are allowed to deduct 0,30 euros for each kilometre between home and work as income-related expenses (and not just the simple distance allowance). Incidentally, 0,38 euros can be charged from the 21st kilometre. Since this is a wage replacement benefit, you do not have to pay tax on the payments, but they are subject to tax progression clause (German), i.e. your personal tax rate may increase as a result.

03.

Care and housework as household-related services

Do you employ people in your household for a fee – for example to do your housework or to provide care services (German) – 20 percent of this can be deducted from taxes up to an annual maximum of 4,000 euros.