Retroactive Tax Returns: How you Can File Them

If you're a mandatory filer, you can submit your tax return retrospectively—up to four years later. For example, if you have not yet submitted your 2021 tax return, now is your chance! Here's how to do file retroactively without missing the deadline.

01.

Submit Tax Returns 4 Years Retroactively

Have you been saving up for a special occasion or do you want to top up your holiday fund? Then you should consider filing a retroactive income tax return. You can voluntarily submit your tax return for each year anytime in the 4 successive years. If, for example, you have not yet filed your 2022 tax return, your paid taxes are not lost. On the contrary, you are still entitled to your due refund! In 2025, you still have the chance to receive a tax refund from 2021.

By the way: You can file your tax returns for several years at the same time and, thus, significantly increase your potential refund (and save time)!

02.

Submitting a retroactive tax return retroactively: Possible timeline

If you are not obligated to file an income return, you can still file your tax return for 2021 and the following years retroactively until the end of 2025.

As an employee, you are generally not obligated to file a tax return. On the contrary, you are granted a longer deadline for filing a voluntary tax return. Of course, you must not have filed a tax return for the respective years. If you meet these requirements, you can take your time.

You can find out whether you have to file an income tax return in our article on the obligation to file .

Attention:

Due to the COVID-19 pandemic, many people have received wage replacement benefits such as unemployment benefit I (Arbeitslosengeld I) or short-time allowance (Kurzarbeitergeld). In most cases, if you earned more than 410 euros in benefits in a particular tax year, you are obligated to file a tax return for that year. You can find more information on this topic in this article .

Your retroactive tax return may bring you a large refund. Exactly how much? Find out in less than half an hour. Start your tax return now.

Prepare your own tax return

From €39.99

Free until your refund calculation – then from €39.99 for submission.

Receive an advance calculation of your refund and pay only when you turn it in

Guided and intuitive process with simple questions

Automatic data retrieval: simply retrieve your income data from the tax office and have it pre-filled

The general deadline applies (July 31st)

€59.99 for married couples or registered partnerships looking to file a tax return together

Save money and secure exclusive benefits with Taxfix+

Get your tax assessment for free and only pay when you submit your return

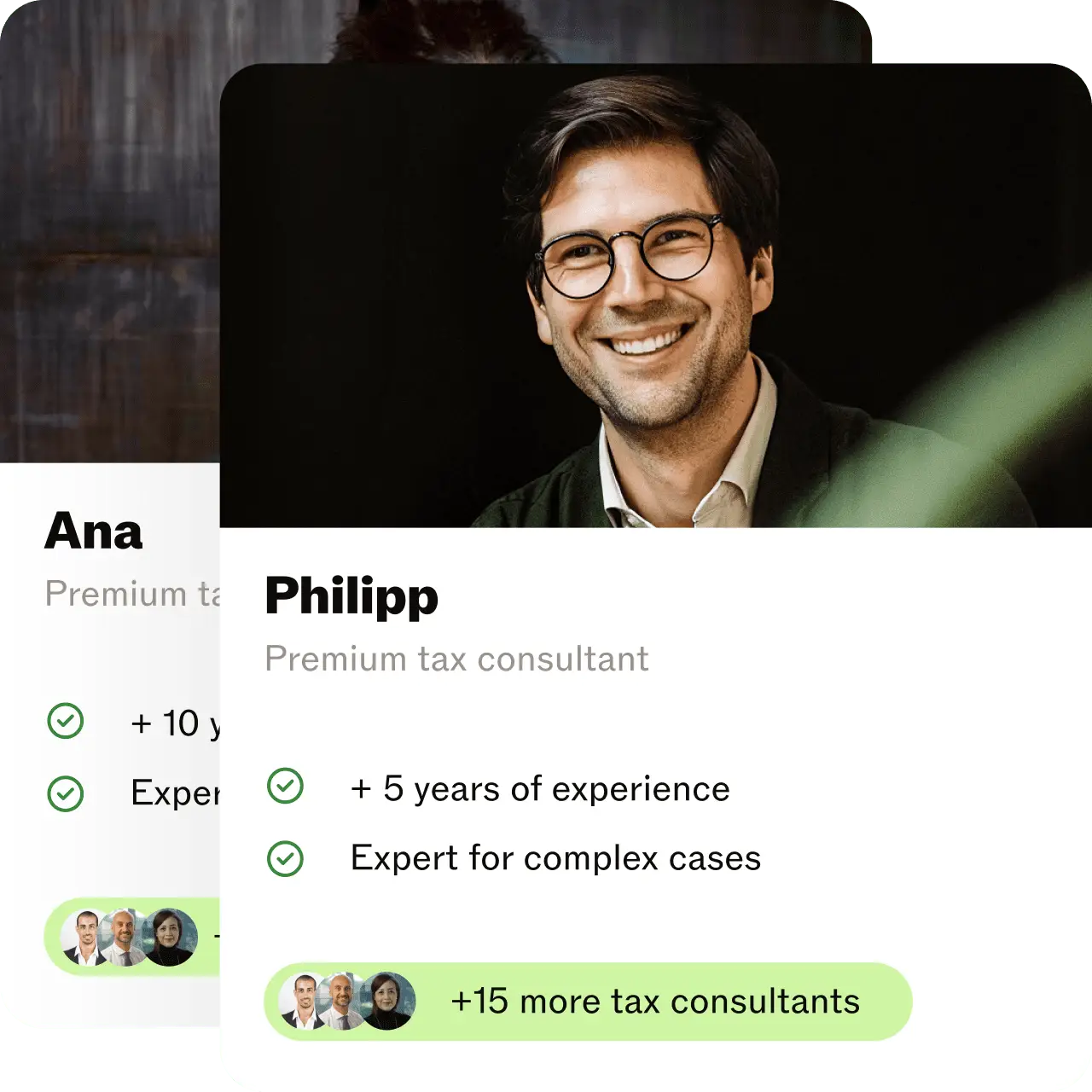

Our Expert Service does it for you

From €99.99

20% of your refund (minimum fee: €99.99).

Provide a few necessary documents in minutes

An independent tax advisor will prepare your tax return for you

Personalised document upload: Only submit documents that are completely necessary

Detailed check of your information

Benefit from an extended tax deadline (April 30th, 2026)

Hand over, pay, relax.

03.

Tip: The tax office will pay you interest under certain circumstances!

When there’s a large gap between the tax year (for which you’re filing a return) and the actual year of submission, you can earn interest on your tax return. The tax office pays interest at a uniform rate from a certain number of months per month. So, if the tax assessment notice is not issued until many months after the respective tax year, you may receive interest payments from the tax office for your retroactive income tax return. Talk about some extra holiday money! Be noted, the same principle applies to back payments as well. If you have tax arrears, you may have to make interest payments to the tax office once you file your returns.

Learn more about interests on tax refunds/paybacks (German) .

04.

Claim loss carry forward (Verlustvortrag) 7 years retroactively

In its ruling of January 13, 2015, the Federal Fiscal Court (Bundesfinanzhof, BFH) has made it possible to retroactively determine loss carry forwards for up to seven years. This is particularly beneficial to students filing an income tax return at a later date.

Students have higher expenses than income. The same also applies to trainees if they had no income during their training period. For these losses, one can claim a loss carry-forward with the tax return. If wage tax is deducted from the first job, the loss carry forward reduces taxes immensely. Start filing and see if you have a chance to earn an interest on your retroactive tax return! Start for free and without obligation. Start your tax return now .

Are retroactive tax returns possible after graduation? Does Verlustvortrag apply to students and trainees?

There’s one catch: only the second degree and the second course of study (which are considered as further vocational training) can be officially classified as tax-deductible as income-related expenses (Werbungskosten) . This principle does not apply to first studies and first training.

The Federal Constitutional Court has ruled (Ref.: 2 BvL 22/14 and others) that expenses for first studies and first training may not be claimed as income-related expenses.

Instead, they are considered special expenses. These are limited to 6,000 euros per year. However, special expenses only affect your tax assessment if you also have taxable income in the same year.

Scan your payslip, and you're done!

It's so simple and completely digital: photograph or upload your documents. Taxfix then automatically transfers all important information. Accurately and stress-free!

Start now for free05.

Retroactive tax return: When the tax limitation period begins to lapse

In most cases, it should be possible to file either your tax return retroactively or carry your loss carry forward for a sufficiently long time. Here are your rough deadlines for retroactive tax filing:

- Tax return 2017

Limitation period for the tax return: Run out

Limitation period for the loss carried forward: 31.12.2024 - Tax return 2018

Limitation period for the tax return: 31.12.2022

Limitation period for the loss carried forward: 31.12.2025 - Tax return 2019

Limitation period for the tax return: 31.12.2023

Limitation period for the loss carried forward: 31.12.2026 - Tax return 2020

Limitation period for the tax return: 31.12.2024

Limitation period for the loss carried forward: 31.12.2027 - Tax return 2021

Limitation period for the tax return: 31.12.2025

Limitation period for the loss carried forward: 31.12.2028 - Tax return 2022

Limitation period for the tax return: 31.12.2026

Limitation period for the loss carried forward: 31.12.2029 - Tax return 2023

Limitation period for the tax return: 31.12.2027

Limitation period for the loss carried forward: 31.12.230

Statute of limitations for tax returns: Deadlines and timelines

As described in the previous section, there are limitation periods for the tax return. In addition to the limitation period for loss carry-forwards and the 4-year period for voluntarily filing a tax return, the tax office imposes further requirements for filing the return. Speaking of voluntary filing: When inactive, you can no longer file a voluntary tax return after the four-year period has lapsed.

These additional deadlines must also be observed:

- If there is a mandate to file taxes, the limitation period of four years starts three years after the end of the tax year.

As an example, for the 2022 tax return, the limitation period for mandatory tax filing starts on 31.12.2025, and lasts for four years. Therefore, the mandatory tax return can be submitted or claimed by the tax office until December 31, 2029. - In case of tax evasion, the four-year period extends to 10 years.

- If taxes are carelessly withheld, extends to 5 years.

Please note that in the event of a late tax return from a mandatory filer, further actions may be taken by the tax office. Late penalties are possible as well.

06.

Retroactive tax submissions: FAQs

- How long is this possible to submit a retroactive tax return? It is possible to file a voluntary tax return up to 4 years after the tax year in question, for example until the end of 2025 for the year 2021.

- I haven’t filed a tax return for years. Can I file again now? You can file voluntarily for the last 4 tax years. It doesn’t matter how long you haven’t filed before that.

- Can I file a tax return 7 years retroactively with a loss carry forward? Yes, that is possible. Losses can be carried forward retroactively for seven years. This is particularly relevant for students and trainees.

- For which years can I file retrospectively in 2025? In 2025, you can file voluntary tax returns for 2021, 2022, 2023 and 2024.

- Can I file several tax returns together? Yes, regardless of whether you use ELSTER (tax office programme) or the intuitive Taxfix app, you can file for up to 4 years at once.

Retroactively reclaim income tax, fulfil your long-held wishes!

Our experts

You're in good hands

Our team of tax experts has years of experience helping people like you with your taxes.