Should I Apply for Child Benefit or Child Allowance?

Families with children have access to child benefit (Kindergeld) and child allowance (Kinderfreibetrag). The tax office can calculate which tax variant is more favourable for you when submitting a tax return.

01.

Child Benefit or Child Allowance: Spot the Difference

Child allowance and child benefit are two financial benefits available to families with children. There are some differences between the two:

- child benefit is paid to one parent every month

- if the income is higher, the child allowance reduces the income tax after submitting the tax return and is not paid out

Get detailed information about the COVID-19 child bonus.

Child Benefit or Child Allowance? You Decide!

You can either use child benefit or child allowance. In any case, you will receive child benefit if you apply for it. The tax exemption is cheaper when calculating the taxes only if you have a certain income. The tax office checks which variant is better for the individual case with the so-called cheaper check (Günstigerprüfung).

You can use the child allowance as long as you are entitled to child benefit.

You are entitled to child benefit until your child has reached the age of 18. Also, it may be continued (on proof) up to the age of 25 if your child:

- is in initial training (studies, school and company training)

- is in a second, advanced training

- is in a transition period between school and training (maximum 4 months)

- has unsuccessfully applied for an apprenticeship (this must be verifiable)

Children with disability are entitled to child benefit beyond the age of 25 only if they cannot provide for their own living. However, the disability must have occurred before the age of 25.

If your child is registered as a job-seeker at a job centre, he/she is entitled to child benefit up to the age of 21.

Prepare your own tax return

From €39.99

Free until your refund calculation – then from €39.99 for submission.

Receive an advance calculation of your refund and pay only when you turn it in

Guided and intuitive process with simple questions

Automatic data retrieval: simply retrieve your income data from the tax office and have it pre-filled

The general deadline applies (July 31st)

€59.99 for married couples or registered partnerships looking to file a tax return together

Save money and secure exclusive benefits with Taxfix+

Get your tax assessment for free and only pay when you submit your return

Our Expert Service does it for you

From €99.99

20% of your refund (minimum fee: €99.99).

Provide a few necessary documents in minutes

An independent tax advisor will prepare your tax return for you

Personalised document upload: Only submit documents that are completely necessary

Detailed check of your information

Benefit from an extended tax deadline (April 30th, 2026)

Hand over, pay, relax.

03.

Child Benefit: How Much Can You Expect?

Child benefit increases almost every year. With the third child, there is a higher benefit to relieve the financial burden of having a large family. From the fourth child onwards, the child benefit increases again for each subsequent child.

child benefit 2025:

- 1st child: 255 Euro per month / 3,060 Euro per year

- 2nd child: 255 Euro per month / 3,060 Euro per year

- 3rd child: 255 Euro per month / 3,060 Euro per year

- from the 4th child onwards, per child: 255 Euro per month / 3,060 Euro per year

child benefit 2024:

- 1st child: 250 Euro per month / 3,000 Euro per year

- 2nd child: 250 Euro per month / 3,000 Euro per year

- 3rd child: 250 Euro per month / 3,000 Euro per year

- from the 4th child onwards, per child: 250 Euro per month / 3,000 Euro per year

child benefit 2023:

- 1st child: 237 Euro per month / 2,844 Euro per year

- 2nd child: 237 Euro per month / 2844 Euro per year

- 3rd child: 237 Euro per month / 2,844 Euro per year

- from the 4th child onwards, per child: 250 Euro per month / 3,000 Euro per year

child benefit 2022:

- 1st child: 219 Euro per month / 2,628 Euro per year

- 2nd child: 219 Euro per month / 2,628 Euro per year

- 3rd child: 225 Euro per month / 2,700 Euro per year

- from the 4th child onwards, per child: 250 Euro per month / 3,000 Euro per year

child benefit 2021:

- 1. child: 219 Euro per month / 2,628 Euro per year

- 2nd child: 219 Euro per month / 2,628 Euro per year

- 3rd child: 225 Euro per month / 2,700 Euro per year

- from the 4th child onwards, per child: 250 Euro per month / 3,000 Euro per year

Scan your payslip, and you're done!

It's so simple and completely digital: photograph or upload your documents. Taxfix then automatically transfers all important information. Accurately and stress-free!

Start now for free04.

Apply for Child Benefit!

If you are expecting a child, you should apply for child benefit. This grant is paid to you every month. You may apply to the responsible family benefits office at your place of residence.

If the child allowance turns out to be more favourable for your taxes, child benefit and allowance are offset against each other, as in the example above.

05.

Child Allowance and Tax Returns

Cheaper Check: Calculate Tax Advantage With Child Allowance

The tax exemption is only worthwhile for spouses with children who have a joint gross income of around 60,000 Euros, whereas for single people with children, from approx. 30,000 Euros. By the way: parents with higher incomes can also benefit from the family bonus introduced at the onset of the COVID-19 pandemic. According to the Federal Ministry of Family Affairs, parents up to a taxable income of 90,000 Euros and one child should benefit financially through the bonus.

On submitting your tax return, the tax office calculates your taxes first with the child benefit and then with the child allowance. The variant more favourable to your tax return is used to determine your final tax. All you have to do is submit a tax return with the required attachment.

The tax experts with the Taxfix app will help you fill out the annexe.

Entering Child Allowance – How Do I Do it?

If you and your partner have a child, going to the registry office is the first official step. Often, hospitals offer to send all the necessary documents to the registry office for issuing the birth certificate. After a week, you will receive the birth certificate in the mail.

Because all public offices in Germany are closely interlinked, the residents’ registration office and the tax office are aware of the child’s birth. The child allowance is then automatically forwarded to your employer via the ELStAM procedure.

So, you don’t have to do anything to register for the tax exemption. It all happens automatically.

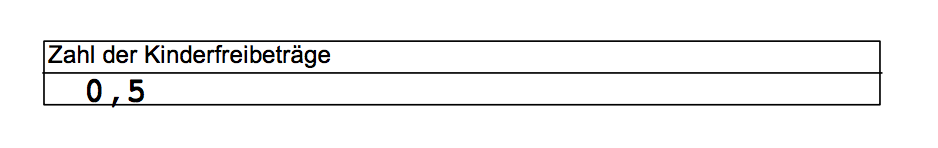

Child Allowance 0.5 on the Income Tax Certificate: What Does That Mean?

It is assumed that parents look after their offspring equally. Therefore, half a child allowance is automatically entered in the wage tax deduction criteria for both parents.

For one child, your income tax certificate usually says:

However, the child allowance does not affect your monthly income tax. On the contrary, it reduces the solidarity surcharge and, if applicable, the church tax.

If you and your spouse jointly assess your taxes, half of your child allowances will be applied to your joint income when you submit your tax return. This means that each of you can benefit from the tax exemption together.

Number of Child Allowance 1.0: Can/Should I Change the Child Allowance?

If you and your partner have two children, there is a child allowance of 1.0 in your wage tax deduction criteria. This means that each of you receives an exemption of 0.5 for each child.

If you only have one child, the number of child allowances per parent can be 1.0 under the following conditions:

- One parent lives abroad

- The other parent adopted the child (step-parent)

- The other parent does not meet at least 75 per cent of his or her maintenance obligation

- The child’s father is unknown

- One parent has died

How Can I Transfer the Child Allowance?

According to Section 32, Paragraph 6, Clause 6-11 of the Income Tax Act, you can transfer half of the child allowance to the following persons:

- The other parent

- The grandparents, if they are responsible for maintenance or if the child lives in their household

- The step-parents, if they have to pay maintenance or if the child lives in their household

To transfer the child allowance, you must fill out Appendix K and send it to the responsible tax office responsible.

Money on my mind – The Taxfix Podcast

We're talking about money! We break the taboo and talk about money with exciting guests every week - without mincing words.

Listen now