Do I state unemployment benefits (ALG1) in my tax return?

Is ALG1 taxed? No, it's tax-free. Yet, you have to state it in your tax return. We explain the reason behind this and the costs you can deduct from tax during this time.

01.

When do I have to submit a tax return?

Receipt of unemployment benefit 1 (Arbeitslosengeld 1 or ALG1) implies that you’re obligated to submit an income tax return. ALG I is one of many income-replacement benefits (article in German).

These are tax-free, which means that no income tax is due on them. You do not have to pay tax on the unemployment benefit.

Nevertheless, you have to pay taxes if your annual income from income replacement benefits is greater than 410 euros. Here’s a list of several income-related benefits:

- Unemployment Benefit I (Arbeitlosengeld I or ALG I)

- Parental Benefit (Elterngeld)

- Sickness Benefit (Krankengeld)

- Insolvency Allowance (Insolvenzgeld)

- Short-time work Allowance (Kurzarbeitgeld)

02.

Why do I enter ALG1 in my tax return?

ALG1 is subject to the progression proviso . This increases the tax rate on your taxable income. In other words, the tax office sees income replacement benefits as an increase in your financial strength and applies a higher tax rate to your remaining taxable income.

Example (for tax year 2020):

You have tax class 1 and have earned EUR 15,000 in 2020 as taxable income. In addition, you received EUR 9,000 in unemployment benefits from April 1st to September 30th. The unemployment benefit by itself is not taxed, but is used to determine the tax rate.

This increases your tax rate from 7.23% to 14.30%. Your 15,000 euros will be taxed with this value. This increases income tax from EUR 1,085 (without progression through ALG 1) to EUR 2,145 (with progression through ALG 1).

You can calculate your personal tax rate and income tax on the website of the Bavarian State Tax Office .

Prepare your own tax return

From €39.99

Free until your refund calculation – then from €39.99 for submission.

Receive an advance calculation of your refund and pay only when you turn it in

Guided and intuitive process with simple questions

Automatic data retrieval: simply retrieve your income data from the tax office and have it pre-filled

The general deadline applies (July 31st)

€59.99 for married couples or registered partnerships looking to file a tax return together

Save money and secure exclusive benefits with Taxfix+

Get your tax assessment for free and only pay when you submit your return

Our Expert Service does it for you

From €99.99

20% of your refund (minimum fee: €99.99).

Provide a few necessary documents in minutes

An independent tax advisor will prepare your tax return for you

Personalised document upload: Only submit documents that are completely necessary

Detailed check of your information

Benefit from an extended tax deadline (April 30th, 2026)

Hand over, pay, relax.

03.

Enter or state unemployment benefit in the tax return

It doesn’t matter whether you were unemployed for the whole year or just part of it: you have to enter unemployment benefits in your tax return because it is subject to the progression clause, as mentioned above.

Enter your information on unemployment benefits in the tax return as follows:

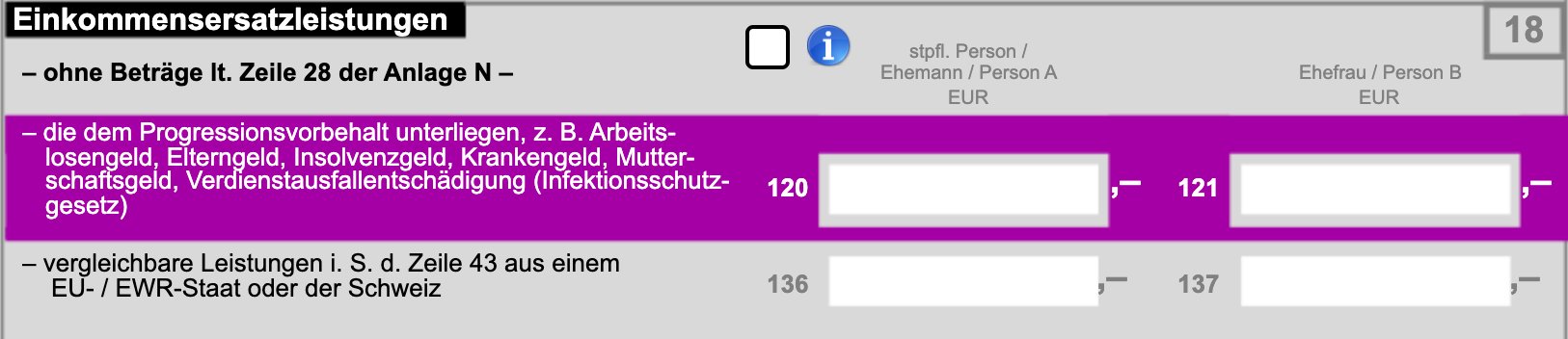

In the Form ESt 1 A(formerly ‘Mantelbogen’, also ‘Hauptform’), the amount received is included in the section on compensation benefits. The appropriate line for this is the 43 (tax form for 2022). Here, you also enter your income from other wage replacement benefits. If you have received several benefits, write down the sum of all amounts here.

Note: Unemployment benefit II (also: ALG II or Hartz IV) is not subject to the progression proviso. You do not have to enter this benefit in your income tax return.

Sounds complicated? It’s easier with Taxfix

With Taxfix you can file your income tax return without any complicated tax forms. Answer a few intuitive questions, and we will send your tax return to the tax office, when you’re ready.

04.

Where can I find information about my unemployment benefit?

You can find the amounts received for wage replacement benefits on the performance record (Leistungsnachweis) that you receive from the relevant social service provider. In the case of unemployment benefit, it is on the certificate from the Employment Agency (‘Arbeitsagentur') . However, the data is also transmitted to the tax office at the same time. Embezzlement is not advised.

05.

Tax rate for spousal-splitting (Ehegattensplitting)

If your taxes are assessed together with your spouse, your income will be added together. The tax office also takes tax-free wage replacement benefits into account. Problem: There may be a higher tax rate and thus a higher tax. The progression proviso also applies here.

If you have received high income replacement benefits, it can be cheaper if everyone does their own tax return.

You can find more information on this in our post on the tax advantages of marriage (article in German).

Scan your payslip, and you're done!

It's so simple and completely digital: photograph or upload your documents. Taxfix then automatically transfers all important information. Accurately and stress-free!

Start now for freeYour advantages

Taxes without forms: Answer our easy-to-understand question-answer process, or have your tax done by an independent tax advisor.

The best way to do your taxes

The choice is yours: complete the simple question and answer process, or use Expert Service and have your taxes done for you by an independent tax advisor. Either way, you can avoid complicated tax jargon.

Learn morePaperless document upload

Taxfix makes your tax return completely digital. Simply photograph or upload your documents. Taxfix then automatically transfers all important information - accurately and stress-free!

Learn moreGet an estimated tax refund quickly

We tell you how much you get from the tax office. Not only do we automatically deduct flat rates that you can use to save taxes, we also show you transparently what information you submit.

Learn moreCompletely secure

Your data is always transmitted in encrypted form to the Taxfix servers and via ELSTER to the tax office. We use secure encryption technologies that are also used by banks.

Learn more06.

Deductions from Hartz 4 through tax refunds

If you receive ALG 2 ("Hartz IV") and receive a tax refund from the tax office, this will be offset against your earnings. According to § 11 SGB II , everything you receive in addition to income replacement benefits counts as income. So is a tax refund. With the judgement of December 16, 2008 (Az.: B 4 AS 48/07 R) by the Federal Social Court, the crediting of the tax refund on the remuneration is considered permissible.

07.

Tax savings through income-related expenses (Werbungskosten)

During unemployment, you will incur costs for applications and possibly further training. You can enter this in your tax return and deduct it.

With the help of the Taxfix app you can easily deduct your expenses for

- Application photos

- Postage

- Commute to the employment office

- Authentication of certificates

as work-related expenses (German article).

If you don’t find another job until the following year, you can deduct the income-related expenses with the loss carryforward next year.

If your costs exceed your income, you can offset the difference accordingly in the income tax return for the following year.

If, by then, you still have no taxable income, your losses (or ‘negative income’) will be shifted to the year after next. For the loss carryforward, you tick ‘Declaration on the determination of the remaining loss carryforward (Erklärung zur Feststellung des verbleibenden Verlustvortrags)’ at the top of the cover sheet of the tax return. In the electronic version with ELSTER, the tick is automatically set when you have made your entries and the minus is visible.

08.

FAQ: Unemployment and tax returns

How is unemployment benefit 1 taxed?

Unemployment benefit 1 is not subject to income tax. This means that recipients do not pay any tax on it. However, it is subject to the progression clause and thus increases the personal tax rate. The progression proviso means that certain income increases your individual tax rate, even though, for example, wage replacement benefits such as unemployment benefits are not taxed.

If, for example, you still received income from employment in the year in question, this will be taxed more heavily than if you had not received unemployment benefit or another wage replacement benefit.

You can find an example under “Why do I have to enter ALG 1 in the tax return?”

Which tax class is the right one if a person is unemployed?

Even if you are unemployed, your marital status is one of the defining factors of your tax class. If you are single, tax class I is the right one, single parents can apply for a change to tax class 2, and for jointly assessed persons (e.g. married persons), tax classes IV, III + V or IV with a factor are possible. Tax class 6 is generally excluded for persons who are unemployed.

You can find out more about the tax classes and which one is right for you in our advice article.

When is a tax return for the unemployed worthwhile?

If you receive unemployment benefit 1, you are generally obliged to file a tax return. The reason for this is that the tax office may demand an additional payment.

In these two cases, however, a lower tax burden and a refund is quite possible:

- Case 1: You worked for a large part of the year and probably paid income tax on this income. Then you can reduce this income by income-related expenses and other deductible expenses. Under these conditions, a tax return can lead to a positive result – so start it now with Taxfix.

- Case 2: You are married, you have tax class IV and your partner is employed. Then a tax refund is relatively likely. As a rule, the working spouse has paid too much income tax during the year.

If it is foreseeable that one of you will become unemployed in the joint assessment, you should consider a change of tax class as soon as possible. The combination III / V is then usually the best choice.

About Taxfix

With Taxfix, you can complete your tax returns from 2019-2022, in no time at all. No tax knowledge is necessary – simply choose to complete your Taxfix tax return yourself, or have an independent tax advisor do it for you. What are you waiting for?

Start now