Sonderausgaben: Tax-Deductible Special Expenses

Sonderausgaben or ‘special expenses’ consist of various costs in your private life, such as pension plans, education, or donations, which are tax-deductible. When correctly deducted, you can earn higher refunds.

01.

Sonderausgaben-Pauschbetrag: The Special Expenses Fixed Allowance

Every year, the tax office recognises a fixed allowance for special expenses or ‘Sonderausgaben’. You do not have to provide any proof or make any entries in your tax return. However, this amounts to only 36 Euros for singles and 72 Euros for married couples when assessed together.

If you have higher special expenses and want them considered in your tax return, you have to declare them in the relevant fields in your tax forms.

Note:

If you are looking for the forms for previous tax years, you can find them all here . Click on ‘Formularcenter’, then ‘Steuerformulare’ and finally on ‘Einkommensteuer’. Select the appropriate tax year and find all forms you’re searching for.

Prepare your own tax return

From €39.99

Free until your refund calculation – then from €39.99 for submission.

Receive an advance calculation of your refund and pay only when you turn it in

Guided and intuitive process with simple questions

Automatic data retrieval: simply retrieve your income data from the tax office and have it pre-filled

The general deadline applies (July 31st)

€59.99 for married couples or registered partnerships looking to file a tax return together

Save money and secure exclusive benefits with Taxfix+

Get your tax assessment for free and only pay when you submit your return

Our Expert Service does it for you

From €99.99

20% of your refund (minimum fee: €99.99).

Provide a few necessary documents in minutes

An independent tax advisor will prepare your tax return for you

Personalised document upload: Only submit documents that are completely necessary

Detailed check of your information

Benefit from an extended tax deadline (April 30th, 2026)

Hand over, pay, relax.

02.

What can I deduct as Sonderausgaben?

Pension Expenses

You can deduct insurance premiums for preventive care (Versicherungsbeiträge zur Vorsorge) as special expenses and save quite a bit on taxes. These include the following:

- Health and long-term care insurance: You can deduct your primary contributions in full up to an amount of 1,900 euros.

- Pension contributions: You can deduct your statutory pension insurance and similar expenses for old-age provision (except Riester pension) for 2022 up to an amount of 25.639 euros (double the amount for couples filing joint taxes).

- Other insurances: If your expenses for basic contributions to your health and long-term care insurance do not exceed the limit of 1,900 euros, you can deduct your unemployment, liability and accident insurance, among other things, up to this limit.

Read more about this in our (German) article on tax deductions for insurance .

Riester pension

Your Riester pension also falls under special expenses. For this, you need to use the 'AV' annexe in your tax return. You can deduct up to 2,100 euros as Riester pension costs.

Alimony payments to your ex-spouse

For divorced persons or couples who live permanently apart, a maximum of 13,805 euros is deductible as alimony paid to their spouse. However, the ex-partner must agree to this special expense deduction. After all, they are then obligated to pay tax on your alimony payment. Our article on alimony and taxes explores this topic in-depth.

Church Tax

If you are a member of the church or other state-recognised religious community, you must pay additional tax. You can deduct an unlimited amount of this tax under special expenses

Vocational training costs

Students in their first degree and apprentices in their first training may deduct a maximum of 6,000 euros of their vocational training costs as special expenses. Beware, this rule changes depending on how many educational courses you have completed before your first degree. However, if it’s your Erststudium (content in German), this article explains how to make it count in your tax return!

Donations and membership fees

You can deduct up to 20% of your income in the form of donations as special expenses (German) . Donations to political parties and independent voter associations are deductible up to the maximum amount of 825 euros for singles and 1,650 euros for married couples assessed together. Of this amount, 50 per cent of the donations reduce your income. If you pay into the assets of a foundation, up to one million Euros is deductible. For married couples assessed jointly, this is two million euros.

You must provide proof of donations in the form of a donation receipt. However, for contributions up to 300 euros, a simple receipt is sufficient. This can be a bank statement or a printout of the booking confirmation.

Childcare costs

In the child annexe, you enter childcare costs that you have incurred, for example, to accommodate your offspring in a daycare centre. Only when you enter them there can you deduct them as special expenses.

Unfortunately, you can only deduct two-thirds of your childcare costs and only up to the maximum amount of 4,000 per year.

Taxes can be simple

We provided you a lot of information that you don’t necessarily need for the tax return

Why? The Taxfix app always works to the latest tax regulations, and we ensure you’re updated on them. Based on this knowledge, you can effortlessly answer our simple questions so that the app correctly recognizes your tax situation. This will be possible in 2025 and from anywhere – via app and browser.

When you correctly declare your special expenses, you can expect the average refund of 1,172 euros in Germany, It takes less than half an hour with Taxfix. File yourtaxes now .

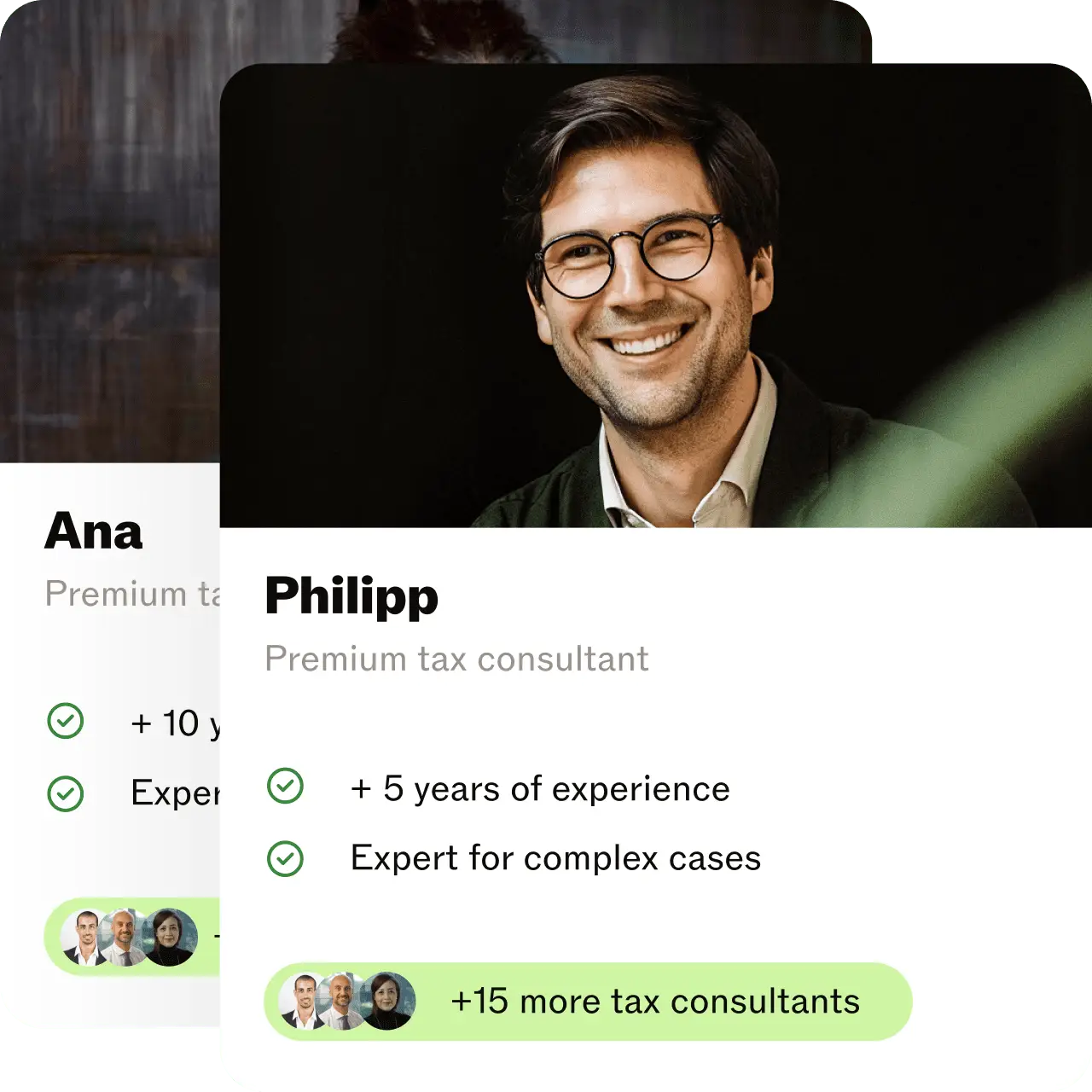

Our experts

You're in good hands

Our team of tax experts has years of experience helping people like you with your taxes.