Tax return 2023/2024: Your complete guide

Your complete guide: All information about the 2023 tax return and which others you can submit in 2024: deadlines, programs and apps, tax liability and what innovations there are in tax law.

Table of contents - Tax return 2022/2023

01.

What do I have to consider for the tax return 2023/2024?

Due to the corona pandemic, many employees had to go to the short-time work (German) exchange. If you were also on short-time work in tax return 2022 and will receive more than 410 euros in wage replacement benefits (such as short-time work benefits) throughout the year, you are obliged to submit a tax return.

Persons who will be working for several employers at the same time are required to submit a tax return. If you are married and have a specific combination of tax brackets with your spouse, you may be required to do so as well. You can therefore also find further details on this and the obligation to pay the fee in this article (German).

If none of the scenarios listed apply to you, filing a tax return is voluntary for you. With a voluntary donation, however, you can improve your finances and save money - just the right thing during or after a pandemic.

Important:

You can currently file your tax return for the 2023tax year. Start the mandatory tax return now and settle the issue of taxes today.

In addition, in 2024it is possible to submit the voluntary tax return for 2020, 2021, 2022and 2023. With these tax returns, you have the opportunity to get money back from the tax office, because: in most cases, the voluntary contribution is worthwhile! You can find all information about this under the contribution to the voluntary contribution (German).

Extend the deadline with the Expert Service

Missed the tax deadline? Have one of our independent tax professionals handle your taxes and buy yourself more time.

Start nowWe have already recovered over 3 billion euros for our customers! Taxfix's mission is to enable financial participation for everyone.

Tax experts work at Taxfix.

Employees counts Taxfix currently.

02.

When do I have to submit my tax return for 2023/2024?

There are deadlines and deadlines for submitting the tax return, which you should adhere to. If you are required to submit a tax, the following tax deadline applies:

Tax return 2023: September 02, 2024

However, if you prepare your tax return with the help of a tax consultant or an income tax assistance association, there is even a time frame up to the year after next. You have until April 30, 2026 with tax advice for your 2023declaration.

We recommend that you submit the mandatory tax return in good time. If you don't manage to do this, there is a risk of reminders and costs, on which a late fee will also be charged. In our guide contribution (German) read.

03.

What do I need for the 2023/2024 tax return and what can I deduct?

A tax return means data, the appropriate numbers and documents. The following documentation is therefore essential:

- Your tax identification number

- Your employer's income tax statement(s).

- Your valid bank details

- Receipts for advertising expenses and special expenses

As you can see, older documents are also key to the correct explanation. You should therefore keep everything that could become tax-relevant in the future. You may be able to claim some of the expenses for tax purposes and recoup some of the taxes you paid.

Such can be job-related expenses for daily work or a move ( advertising expenses - German ) and other financial burdens. The following articles will give you more information about each type of expense that you can claim for tax purposes:

Prepare your own tax return

€39.99

For anyone who wants to file an easy and secure tax return themselves. Free refund calculation, pay only upon submission.

Receive an advance calculation of your refund and pay only when you turn it in

Guided and intuitive process with simple questions

Automatic data retrieval: simply retrieve your income data from the tax office and have it pre-filled

The general deadline applies (September 02)

€59.99 for married couples or registered partnerships looking to file a tax return together

Get your tax assessment for free and only pay when you submit your return

Our Expert Service does it for you

From €89.99

For those who are unsure or can't find the time – hand your taxes to an expert.

Provide a few necessary documents in minutes

An independent tax advisor will prepare your tax return for you

Personalised document upload: Only submit documents that are completely necessary

Detailed check of your information

Benefit from an extended tax deadline (June 2nd, 2025)

Hand over, pay, relax.

04.

What do I have to consider when filing my 2022 tax return?

Corona and the war in Ukraine have changed a lot financially. A closer look at the tax changes is therefore a recommendation that can be worthwhile. All in all, for the tax year 2022 there were more relief for donors.

Here some examples:

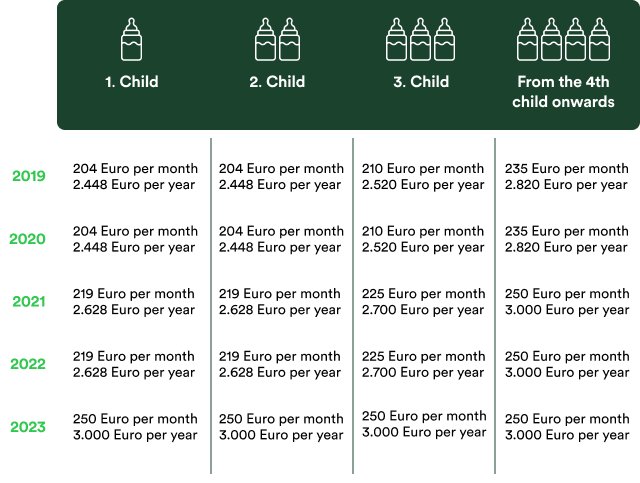

Child benefit and child allowance increase

The child allowance increased from the start of 2022 to 2,810 euros for each parent and the childcare allowance to 1,464 euros. This results in an allowance of 4,274 euros (or 8,548 euros for couples who file a joint tax return).

You can see the new child benefit amounts in this table:

The basic allowance has been increased

The tax authorities have the basic allowance (German) elevated. This is the amount on which you do not have to pay income tax. You can see which value applies to the 2022 tax return in the corresponding row of the table.

tax year | basic free allowance |

|---|---|

2019 | € 9,168 |

2020 | € 9,408 |

2021 | € 9,744 |

2022 | € 10,347 |

2023 | € 10,908 |

2024 | € 11,604 |

The home office flat rate also applies to the 2022 tax year

The corona pandemic has given home office a new role in Germany. It ensures that people do not drive to work. As a result, the commuter allowance or distance allowance cannot be used. However, since the home office is a financial burden, there is a home office flat rate.

You can find out more about working from home and the commuter flat rate read here (German) .

Other changes in tax law

In this article, we will show you all of them other tax changes (German) , which will apply from the tax year 2022. With it, people who do not have a severed Workspace (German) still deduct costs. If the workplace is not physically separated in your own home, you can claim 5 euros per day. There is a maximum amount of 600 euros.

Taxfix advantages for all

With Germany's most popular mobile tax app, you can do your tax return in no time.

Guided and intuitive process

Answer our easy-to-understand questions, or sit back and have your taxes done by an independent tax advisor.

Reliable check of your data

We check your data for plausibility through sophisticated plausibility checks.

Estimated tax refund, free of charge

If you choose to file your own taxes with Taxfix, we’ll calculate how much you can expect back from the tax office.

Efficient and secure tax returns

Only answer what's related to your case. Or have your taxes prepared and submitted by an independent tax advisor.

05.

How to do the voluntary and mandatory tax returns in 2024?

There are several ways to submit a tax return to the tax office. The official variant is the software or the browser program ELSTER (German), which stands for Electronic Tax Return. Private users can use the ELSTERonline portal to create and edit their tax return and send it to the tax office. This is done by filling out the digital forms and emerges from the previous paper forms. That is why ELSTER is sometimes accused of a lack of user-friendliness.

Save yourself ELSTER and a tax return that gets on your nerves. You can make your taxes 2023more convenient and easier and without any tax knowledge or software - with the Taxfix App . Because unlike at ELSTER, with us, you don't fill out any complicated forms, which usually require a high level of tax knowledge. You answer easy-to-understand questions that guide you through your personal tax case, because submitting your tax return should give you pleasure and not cause frustration.

With the plausibility check, Taxfix ensures that errors in your tax return are less likely. Plus, you can submit in under an hour and get a nice refund if you can!

The transmission to the tax office is technically regulated via the official ELSTER interface and is therefore secure. What Taxfix also convinces many customers every day:

Your advantages with Taxfix

- Simple questions instead of complicated forms

- No previous tax knowledge required

- Checking your information for plausibility

- Pre-estimate your eventual refund

- Encrypted transmission of the tax return via the ELSTER interface

- Can also be used in English

- Your tax estimate is free.

- If you submit your tax return with Taxfix, we charge a fee for the transmission via the secure Elster interface.

- On the side of Taxfix costs you can find the current prices.

If we've piqued your curiosity, you can here. Have your tax refund estimated in advance by our tax calculator in the browser without obligation.

Good to know:

There are now many alternatives to ELSTER. They differ in terms of functionality, program vs. browser-based vs. app and also in price. They often make the tax return easier to understand and offer tools that go beyond those of ELSTER.

Our experts

You're in good hands

Our team of tax experts has years of experience helping people like you with your taxes.