Tax return for trainees: How to save on income tax

Whether you have to pay wage tax during your training, whether you have to file a tax return & how you can save on taxes.

01.

Your trainee tax return is also easy

You have probably heard about the tedious subject of tax returns from your parents, friends or somewhere else. So you can understand that trainees are also thinking about it, after all, most trainees already have their salary transferred.

Secondly, for many people - probably except for people in tax consultant training - questions and doubts resonate with the topic.

The modern tax return

There is much resentment about the annual declaration to the tax office because of the complicated process that this project used to involve. The tax information was given using printed forms (these can now also be filled out online).

The current online version called Mein Elster is a bit simpler, but probably not intuitive.

ELSTER is the program of the tax office, i.e. the official and long time without alternative means for the tax return. With Mein Elster you can also fill out the forms via browser, but without knowing the tax terminology it is quite complicated.

Luckily, for some time there have been providers who collect personal tax data more easily than with endless and not very intuitive forms.

One such provider is Taxfix. With Taxfix you don't need any tax knowledge. You can go through your tax return step-by-step using simple language and a question-and-answer procedure. You can't go wrong!

After answering the questions, the amount of the expected tax refund will be calculated immediately. So you can see immediately and without risk how much money you can expect from the tax office.

If you are satisfied, your tax documents will be created and sent to your responsible tax office without paper. By the way, you can do your tax return when and where you want: at home with you the calculator or on the go your iPhone or Android phone .

Taxfix tipp:

As a trainee, you usually do not have to submit a tax return. But in most cases it's worth it.

Because many issues of your Training (German) you can get it back with your tax return, even if you hardly paid any taxes in the year.

Prepare your own tax return

From €39.99

Free until your refund calculation – then from €39.99 for submission.

Receive an advance calculation of your refund and pay only when you turn it in

Guided and intuitive process with simple questions

Automatic data retrieval: simply retrieve your income data from the tax office and have it pre-filled

The general deadline applies (July 31st)

€59.99 for married couples or registered partnerships looking to file a tax return together

Save money and secure exclusive benefits with Taxfix+

Get your tax assessment for free and only pay when you submit your return

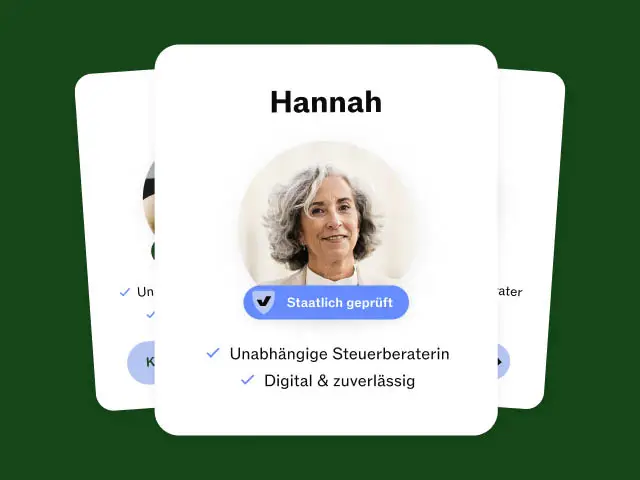

Our Expert Service does it for you

From €89.99

20% of your refund (minimum fee: €89.99).

Provide a few necessary documents in minutes

An independent tax advisor will prepare your tax return for you

Personalised document upload: Only submit documents that are completely necessary

Detailed check of your information

Benefit from an extended tax deadline (April 30th, 2026)

Hand over, pay, relax.

02.

Four at once: Submit the trainee tax return for several years

With Taxfix you can calculate your training costs for 2021, 2022, 2023 and 2024. In the mobile app or via browser, for example on the computer, you have your own entry for the past four years.

This gives you a chance to get a big tax refund from the tax office. Treat yourself to a holiday, clothes or invest the money with this money – you are entitled to it!

And the best thing is: With Taxfix you can stop researching your tax return right now: In the app we ask you all the relevant questions so that you can get as much out of your tax as possible!

So you save yourself long research about possible costs that you can deduct from taxes.

03.

Tax return as a trainee: Here's what you can deduct

Therefore, the tax return can be worthwhile as an apprentice: you can deduct costs that you have incurred during the tax year in question and get money back from the tax office. This is basically possible for these outputs:

- Fees for admission, courses and examinations

- Travel expenses to the training center and vocational school

- Costs for work equipment and learning materials

- moving expenses

- Costs for a second home at the training location

- expenses for applications

Simplying the tax return

Taxfix makes filing your income tax much easier. Here are some examples that show how.

Fast tax return with Taxfix

In times of user-friendly services, personalized apps and individuality, tax returns no longer have to cause fear or even take a long time. On average, you submit the tax return with the Taxfix app in less than half an hour.

Tax return without forms

Taxfix makes it possible to submit the tax return without any forms. The tool uses easy-to-understand questions instead of forms - so it's almost playful via app or web browser to explain to the tax office - without fear of filling out something wrong!

Digital and simple - thanks to innovative technology

Taxfix makes the tax return digital. Photograph your documents directly with the smartphone app or upload documents from your computer. Taxfix automatically transfers all important information - stress-free and error-free.

Expert service

Don't want to spend time on taxes? Then let your tax return be done in a relaxed manner by state-certified tax consultants. Just upload some documents and receive your tax declaration in a few days. All you have to do is check and approve them - done!

Data retrieval for even more convenient submission

Use tax office data and save time with taxes: With data retrieval, a lot of your tax data is retrieved directly from the tax office and automatically entered in your tax return. Less paperwork for you and the tax return will be ready even faster than before! We call it Datenabruf.

Try it for the first time? The tax calculator

With the tax calculator from Taxfix you can check whether a tax return is worthwhile. Get an uncomplicated estimate of the amount of your possible refund. This happens based on a few questions that you have answered quickly. If you want a more accurate estimate, please use the Taxfix app.

04.

More on the trainee tax return: First or second training

How you can deduct an education from the tax depends crucially on whether it is the first education or second education.

The content listed here applies to those who went straight into training after school.

If an apprenticeship or degree was obtained before the current/relevant apprenticeship, this is referred to as a second apprenticeship.

For claiming the training costs, this means:

You can specify special expenses during initial training.

In the case of a second degree, expenses can be considered income-related expenses. A loss carryforward ("Verlustvortrag") is also possible.

More to dropping out of training (German), including the second degree, can be found in our dedicated guide.

We have already recovered over 3 billion euros for our customers! Taxfix's mission is to enable financial participation for everyone.

Tax experts work at Taxfix.

Employees counts Taxfix currently.

05.

Loss carryforward ("Verlustvortrag"): Save future taxes with the training

Important note

The Federal Constitutional Court has decided (Az: 2 BvL 22/14 and others) that expenses for the first training may not be claimed as income-related expenses!

They are instead considered special expenses (German).

These are limited to 6,000 euros per year. However, special expenses only have a tax effect if they are made in the same year taxable income (German) consist.

Even if you earn little money in your second degree and your training costs are higher than your income, you should file a tax return.

This is how it works: When you submit your tax return to the tax office, your income and expenses are offset against each other. If you have a loss due to excessive costs, you take this into the next tax year, where it is then offset against the income there.

With this so-called loss carried forward ("Verlustvortrag", German source), which is possible with second training, you can take your losses with you into the time after your training. When you then earn your first money, you save taxes in the first year of work with your training.

Money on my mind – The Taxfix Podcast

We're talking about money! We break the taboo and talk about money with exciting guests every week - without mincing words.

Listen now